Analyzing the Cash Flow Statement

Table of contents

Understanding financial reports are the goal

Dissecting the cash flow statement is a gamechanger. Understanding how to read the income statement and the balance sheet is a great skill. But, looking at the numbers through the prism of the statement of cash flow is the “coup de gras” of comprehending the business story. In contrast, the knowledge gained by seeing the cash thrown off by income statement and balance sheet activities, you can read “the story.” Moreover, isn’t the goal to read “the story” given by the financial statement?

[fix]The cash flow statement is part of the scorecard of a business. The statement tells you everything about how profitable and healthy that company has been in recent years. Moreover, it will help when making decisions on what projects should go forward next or whether there are any potential pitfalls ahead for them with these plans at hand already knowing where their money goes each month (or quarter).

How dissecting the cash flows impacts strategy.

Think of the cash flows from the impact of your strategy and decision-making. How is it monitored? Moreover, how will the cash flows affect the company’s ability to stay in business?

Cash flow is the lifeblood of any business. Consequently, the statement measures the cash coming in and out of a company. Meanwhile, cash flow is one of the most critical indicators of a company’s financial health.

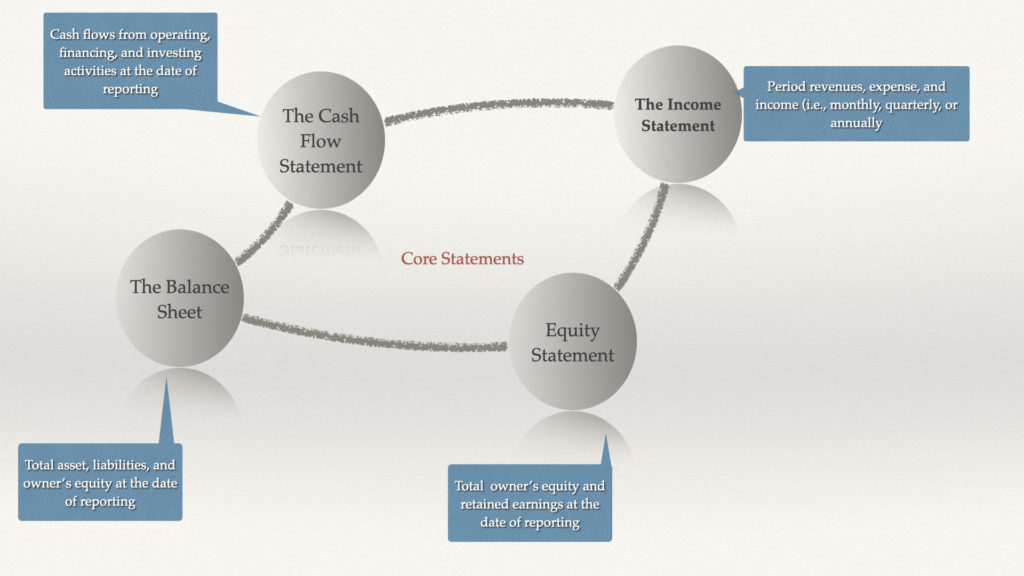

Above all, the cash flow statement converts accrued accounting reporting on the balance sheet, the income statements, and shareholders’ equity statement into their cash impact as they are linked.

The cash flow statement makes the other reports meaningful.

Most companies report transactions using the accrual method. If you’ve ever tried to balance your checkbook, you know that cash accounting doesn’t give you the whole story. However, with accrual accounting, you can get a much better picture of your financial situation. That’s because accrual accounting recognizes revenue when it’s earned, rather than when it’s received. So, if you’ve completed a job but haven’t yet been paid, your accrual-based income statement will still reflect that revenue. Similarly, expenses are recognized when they’re incurred, even if you haven’t yet paid the bill. Consequently, accrual accounting provides a more accurate picture of your company’s financial health and can help you make better decisions about managing your cash flow.

The cash flow statement makes everything else meaningful. Most importantly, we benefit from them capturing all cash activities in a period. Whether or not it generated accrual profits, the cash effect is equally or more important.

Often overlooked cash effect.

The cash effect is often overlooked when making decisions. The way you see your statements will not reflect what’s really happening with the money as well as missing out on important information, like how much positive or negative cash was in a certain period of time. We want to ensure we don’t miss the cash effect in our decision-making. You’re missing an essential piece of the puzzle, the cash impact, as shown with the cash flow statement. Consequently, you will be unable to see the big picture with the cash flow statement.

Knowing how much cash you’re making and what’s going into your company helps keep things running smoothly. As such, knowing the financials of any given business is critical information for its owner or manager to have in order not only to understand their own success but also to identify areas that may need improvement if they arise at all

Cash flow, the business lifeboat

Cash is the lifeblood of business, and without it, there would be no payments to employees or suppliers. However, under accrual accounting for companies with explosive growth, this can create problems because they need more funds than what’s reported in their books so if something goes wrong then you’re eventually going to come short-duty on whatever loans were taken out based on these financial statements which could lead them towards bankruptcy.

Accrual accounting enables a more accurate picture of its financial position. The problem with the cash basis of accounting is that it can be misleading. For example, a company could have $1 million in receivables, but it’s in trouble if it doesn’t have the cash to pay its bills. Remember, accounts receivables are IOUs from customers the company extended credit. Until collected, you need other cash sources to run the business.

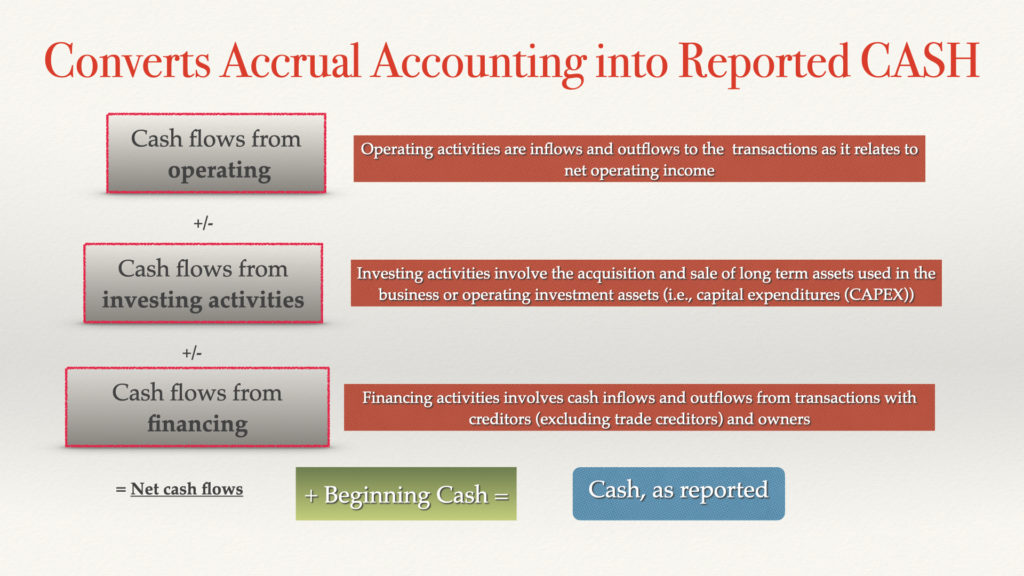

Converting accrual transactions to cash

The statement of cash flows shows how much actual cash came in and out during a given period. What matters is the transactions are ultimately paid with cash. But more important, it is cash that allows businesses to pay their obligations, reinvest in their operations, and return money to shareholders.

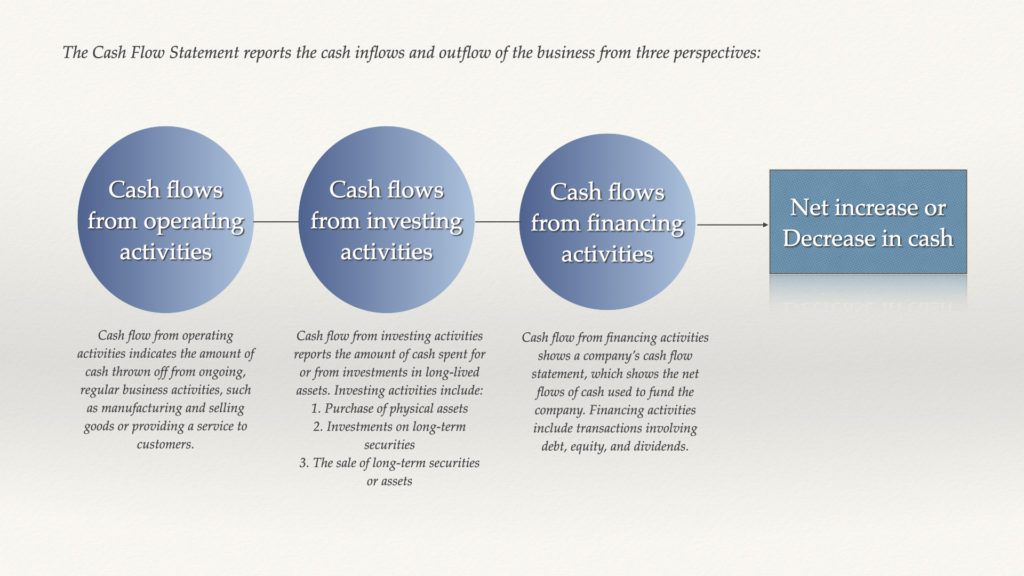

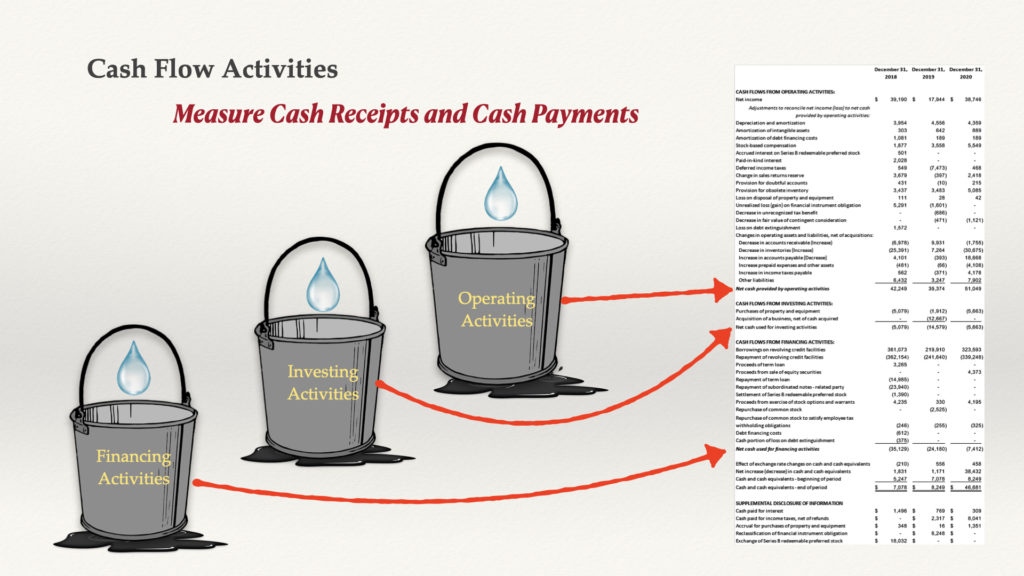

The cash flow buckets

Look at the cash flow statements from the perspective of three buckets in which cash activities were generated and paid out:

- Operating activities,

- Investing activities, and

- Financing activities.

Conversely, you must understand from the standpoint of cash activities and effectiveness.

Each bucket has its own set of cash inflows and outflows. Therefore, it’s essential to understand the cash flow from each bucket because it can give you insight into a company’s financial health.

- Cash flows from operating activities are cash generated from business activities. And it includes selling products and services, collecting receivables, and paying bills.

- Additionally, cash flow for investing activities is cash generated from investments such as new equipment or the sale of assets.

- Finally, cash flow from financing activities is cash generated from borrowing money from a bank or selling new shares of stock.

Operating Cash Flows

To start, let’s discuss cash flows from operating activities. Operating cash flow measures the money coming in and out of a company from its core business activities. It includes things like sales as well as expenses and taxes. Overall, cash flow from operating activities is critically important because it shows whether a company is generating enough cash to pay its bills.

The direct method for reporting cash flows from operating activities

Under the direct method, cash receipts and cash payments from operating activities. Cash receipts are things like customer payments and interest income. Additionally, it reports cash payments such as employee salaries and supplier invoices.

Cash flow from operating activities using the direct method reports as follows:

- Operating cash flow = Cash provided by operating activities – cash distributed for operating activities.

Cash provided from operating activities:

- Cash received from customers = Net sales + beginning accounts receivables – (the cost of goods sold + accounts receivable write-offs)

- Plus cash interest received

- And cash dividends received

Cash distributed for operating activities

- Cash paid to suppliers = Cost of goods sold + (ending inventories +beginning accounts payables) – (depreciation [*manufacturing co.] & amortization + beginning inventories + ending accounts payables)

- With cash paid for operating activities = Operating expense + (ending prepaid expenses + beginning accrued expenses payable) – (depreciation and amortization + beginning inventories + ending accrued expenses payable)

- Including cash interest paid

- And cash paid for taxes

Net cash flow from operating activities

The direct method provides more excellent predictive value to assess how much cash customers generate. Likewise, other reasons include showing the relationship between cash and accrual basis net income.

It’s essential to understand cash receipts and payments. Hence, the cash movements can give you insight into a company’s financial health.

The indirect method for reporting cash flows from operating activities

Cash flows from operating activities from the indirect method start with net income and adjust to account for items that don’t directly affect cash itself.

Cash from operating activities reports as follows:

- Operating Cash Flow = Net Income + Depreciation & Amortization + (Gain or Loss from Sale of Assets) – (Increase or Decrease in Working Capital)

- Net income is the starting point for calculating operating cash flow.

- Depreciation and amortization are non-cash charges and include—depreciation charges for the wear and tear of a company’s assets.

- Gains or losses from the sale of assets adjust back—any gains or losses from the sales reports on the investing cash flow activities.

- Working capital changes impact cash.

Working capital is the difference between a company’s current assets and current liabilities. Consequently, with the use of the direct method, the inclusion of the indirect methodology is required as a reconciliation.

Investing Cash Flows

Investing cash flow measures a company’s money to buy or sell assets. Additionally, includes buying a new property, land, and equipment or selling investments.

Capital expenditures (CAPEX)

For business owners to survive in the long term or improve processes and profitability, capital expenditures are critical. Notwithstanding, many entrepreneurs do not take CAPEX seriously. And earnings tend to decline over time.

Financing Cash Flows

Financing cash flow measures a company’s money to finance its activities. Consequently, this can include things like issuing new equity or borrowing money.

External borrowings

Cash flows from financing activities report to borrowing activities of the business and the cash used to pay down the debt principal.

New equity securities

Cash received from the issuance of new securities.

A cash flow statement is an essential tool for investors to understand a company’s financial well-being. Overall, reviewing external borrowing can give insights into a company’s cash-raising abilities.

Additionally, it will enable you to assess the company’s investment and credit qualities that support working, including new capital and financing capabilities.

Cash flow is an integral part of any business. You must monitor the cash flow statement closely. By all means, monitoring financing cash flows is a critical financial metric. It can give insights into a company’s ability to raise capital.

To Summarize

To sum it up, the cash flow statement is an essential tool for investors and business owners. By understanding how a company generates, uses, and distributes cash, you can make more informed investment decisions. Thus far, this blog shows you the importance of the cash flow statement. Have you ever used the cash flow statement to inform your investing decisions? What was your experience? Let us know in the comments below.

A cash flow statement is an essential tool for investors and business owners. The information on how a company generates uses distributes, or loses its cash can help you make more informed decisions about when and where to invest in the business. It gives an idea about what may happen next with your business, as well as provides feedback from previous investments that have already been made!

FAQs

1. What is cash flow?

Cash flow is the movement of cash. Additionally, the cash flow statement gives us insights into a company’s financial health and ability to meet its obligations.

2. How is cash flow different from net income?

Financial statements report the net income on an accrual basis. Conversely, the cash flow statement converts accrual income to the cash movements of the business.

3. What are the three types of cash flows?

The three types of cash flows are operating cash flow, investing cash flow, and financing cash flow.

4. How can I use the cash flow statement to inform my investment decisions?

The cash flow statement is a crucial financial statement that can give insights into a company’s financial health. At the same time, by understanding how a company generates, uses, and distributes cash, you can make more informed decisions.

5. What is the cash flow statement?

The cash flow statement is a financial statement that shows how a company generates and uses cash. Finally, the cash flow statement will provide insights into a company’s financial health and ability to generate cash.

Courses Designed for You

Read the financial statements through:

Understanding the balance sheet, income statement, and cash flow statement, even if you have no experience with financial statements. However, do you know that financial statements tell a story?

Interpret financial statements through:

Analyzing financial statements using profitability ratios i.e., Gross Margin (Cost of Goods Sold / Revenue), Operating Margin (EBITDA/ Revenue), Net Profit Margin (Net Income / Revenue), Return on Assets (Net Income / Assets), and Return on Equity (Net Income / Equity).

Gary Rushin is a certified public accountant. With over 40 years of experience, Gary Rushin’s depth and breadth of experience include investment and commercial banking, business insolvency and turnaround professional, and teaching executive MBA programs to name a few. Most recently, Gary successfully turnaround an insolvent 70-year-old manufacturing company winning numerous awards.