Table of contents

- The business scorecard: accounting

- Accounting is the company scorecard

- 60 percent of small business owners do not know their accounting

- Should you do your accounting?

- What is accounting?

- What are the financial statements?

- Audited, reviewed, and compiled financial statements

- Conclusion

The business scorecard: accounting

Business information is conveyed through accounting, which tells the story of a company’s financial performance and wellbeing. Accounting, through financial statements, provides insights into a company’s overall health, profitability, and cash flow. The financial statements report the business scorecard and are designed for external users. It is essential for business owners and managers to understand accounting and the broad range of information provided to make informed business decisions. And understanding allows for adjusting the business. Continuing education is critical. And, I ask these questions. How are the business owners going to attract potential investors? How are the business owners going to plan their business taxes? Consequently, the answer is understanding the financial reports and financial accounting.

Accounting is the company scorecard

According to Merriam-Webster, a scorecard is a report or indication of the status, condition, or success of something or someone. Based on the financial records, the financial recording accumulates financial transactions sometimes put together by certified public accountants, or other professional accountants, on the status and condition of the enterprise. The scorecard is designed for external users to make informed decisions. And most financial statements are similar to financial reports of publicly traded companies that follow the requirements of the Securities and Exchange Commission. For private companies, reporting financial records, as well as an audit of a private business, follow generally accepted accounting principles.

60 percent of small business owners do not know their accounting

According to the Small Business Report Accounting, 60% of small business owners feel that they might not have enough knowledge about finance and accounting. This is a troubling statistic, as financial literacy is essential for small business owners. Without a basic understanding of financial statements and accounting principles, you will have difficulty making sound decisions. And deciding about how to allocate resources. As a result, many small businesses fail to reach their full potential due to a lack of financial literacy. While there are many financial literacy programs available. It is important for small business owners to take the initiative to educate themselves about financial matters. Consequently, small business owners should increase their financial knowledge of financial accounting to thrive. Additionally, entrepreneurs’ use of management accounting systems will enhance their control of the business.

Accounting, the process of recording, classifying, and summarizing financial transactions, provides useful information for making business decisions. With the use of management accounting systems, financial statements are an important part of accounting, and they show a company’s financial position, performance, and cash through off. The three most important financial statements are the balance sheet, profit and loss statement (P&L), and cash flow.

Should you do your accounting?

As a small business owner, you may be wondering if you can do your own accounting (bookkeeping). The answer is yes! Bookkeeping is not as complex or time-consuming as you may think. Beyond having up-to-date, organized, and compliant records of business finances, bookkeeping can give you the insight you need to plan for growth. One thing is certain, if you do your own bookkeeping, you’ll really understand your business’s bottom line. This is a requirement. Thus, you must understate the financial reporting.

Several benefits to doing your own accounting

There are several benefits to doing your own bookkeeping:

1. You’ll save money. Outsourcing bookkeeping can be expensive. You’ll keep more of your hard-earned money in your pocket by doing it yourself.

2. You’ll gain valuable insights into your business. When you have a clear understanding of your business finances, you can make informed decisions about where to allocate your resources.

3. You’ll be able to spot problems early on. Bookkeeping provides early warning signs of financial trouble. By catching problems early, you can take steps to remedy the situation before it gets out of hand.

4. You’ll have a better handle on your taxes. You’ll have a complete and accurate record of your income and expenses when you do your own bookkeeping. This will come in handy come tax time.

5. You’ll be prepared if you need to apply for a loan. If you ever need to apply for a business loan, your bookkeeping records will be a valuable asset. Consequently, lenders will want to see that you have a good handle on your finances before they approve your loan.

So, there you have it. Doing your own accounting is not as difficult or time-consuming as you may have thought, and the benefits are well worth the effort. Overall, if you’re ready to take control of your finances, understand how to read the financial reports based on the financial records.

The Benefit of using an accountant or bookkeeper

While there are many benefits to doing your own bookkeeping, there are also benefits to outsourcing this task to a professional. Here are a few reasons why you may want to hire a bookkeeper or accountant:

1. You’ll save time. Bookkeeping can be time-consuming, especially if you’re not familiar with the process. By hiring a professional, you can free up your time to focus on other aspects of your business.

2. You’ll have peace of mind knowing that your records are in good hands. A professional bookkeeper or accountant will keep accurate and organized records, giving you peace of mind that your finances are in good hands.

3. You’ll have someone to bounce ideas off of. A good bookkeeper or accountant can offer valuable insights and advice when it comes to your finances. They can help you make informed decisions about where to allocate your resources.

Overall, there are many benefits to both doing your own bookkeeping and outsourcing this task to a professional. It’s important to weigh the pros and cons of each option to decide what’s best for you and your business.

The Benefit of using a certified public accountant

Unlike a bookkeeper or general accountant, licensed certified public accountants (CPAs) bring many benefits.

1. CPAs are required to adhere to high ethical standards. This means that you can trust them to give you accurate and honest advice.

2. A certified public accountant has extensive knowledge of tax laws and regulations. This means that they can save you time and money by preparing your taxes in the most efficient way possible.

3. CPAs are trained to spot financial problems. This means that they can help you avoid financial difficulties before they get out of hand. Additionally, many CPAs know forensic accounting.

4. A certified public accountant provides valuable insights into your business finances. CPAs can break down financial transactions. This means that you can make informed decisions about where to allocate your resources.

5. CPAs can help you plan for growth. Understanding your business finances can help you develop a strategy for increasing revenue and reducing expenses.

Using CPAs for decision-making

Overall, using a certified public accountant is wise for any small business owner. They can save you time, money, and stress in the long run and bring a broad range of skills. Additionally, most professional accountants have accounting degrees and require to maintain continuing professional education. Those interested in the accounting profession to obtain the accounting designation must understand cost accounting, management accounting, tax law, generally accepted accounting principles, and pass the CPA exam.

What is accounting?

Accounting is recording, classifying, and summarizing financial transactions to provide helpful information in making business decisions. Financial statements are an essential part of accounting, and they show a company’s financial position, performance, and cash flow. The most important financial statements are the balance sheet, income statement (profit and loss statement), and cash flow. Financial history shows that an Italian monk, Luca Pacioli, developed the accounting system known as financial accounting.

Business accounting is the systematic recording, analyzing, interpreting and presenting of financial information. Accounting may be done by one person in a small business, or by different teams in large organizations. Accounting is the way a business keeps track of its operations.

Xero accounting software

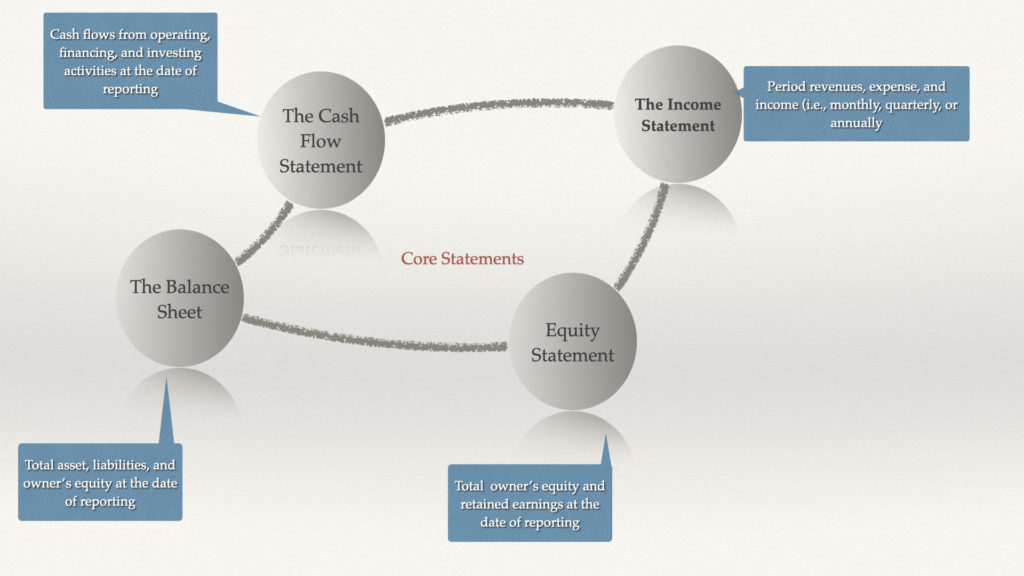

What are the financial statements?

Financial accounting is an essential part of financial statements, and they show a company’s financial position, performance, and cash flow. The most important financial statements are the balance sheet, profit and loss, shareholders’ equity statement, and cash flow, based on financial accounting.

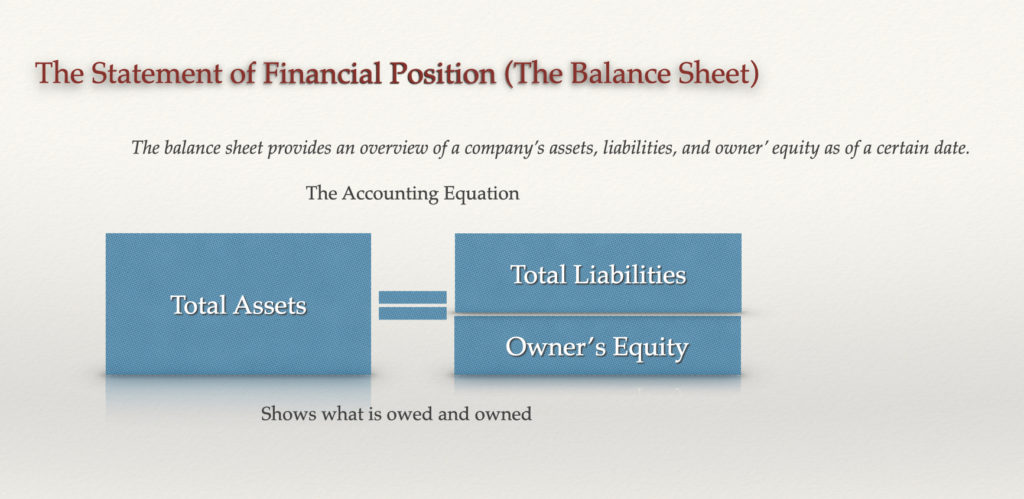

What is the balance sheet?

The balance sheet (aka statement of financial position)is a financial statement that shows a company’s assets, liabilities, and shareholders’ equity. It is crucial for business owners and managers to understand the company’s financial position. It provides insights into a company’s overall financial health. Additionally, it allows for the understanding of the tax liabilities.

The assets section of the balance sheet shows a company’s resources, while the liabilities section shows a company’s obligations. The balance sheet is essential for business owners and managers because it provides a snapshot of a company’s financial position.

Not too many people know how to use the balance sheet

What if everything you’ve been taught about the balance sheet is a lie? I’m going to suggest that, even though balance sheets are widely used in business and seem very tangible, not many people know how they should be best applied.

The way I’ll describe it is a bit unorthodox but effective. Financial accounting will allow you to look beyond the previous returns of your company’s stock and make more accurate predictions for its future. It can also help you take better control over financing options while also minimizing risk.

So let me tell you what I mean by this: Liquidity, leverage, and solvency all depend on one another — just like walking upstairs. You’re not getting the full story if you’re looking at only one factor when using the balance sheet to run your business. Let’s take a closer look at what I mean by this.

Liquidity

Liquidity is the ability of your company to pay its short-term debts. This is important because you’ll go bankrupt if you can’t pay your bills. To calculate liquidity, you need to look at two things on the balance sheet: current assets and current liabilities. Financial accounting allows you to determine working capital.

Leverage

Leverage is the amount of debt your company has relative to its equity. This is important because too much debt can make your company insolvent — meaning it can’t pay its debts. To calculate leverage, you need to look at two things on the balance sheet: total assets and total liabilities. Through financial accounting, you are able to determine a company’s leverage.

Solvency

Solvency is the ability of your company to pay its long-term debts. This is important because you’ll go bankrupt if you can’t pay your loans. To calculate solvency, you need to look at two things on the balance sheet: total assets and total liabilities. Through financial accounting, you are able to determine a company’s solvency.

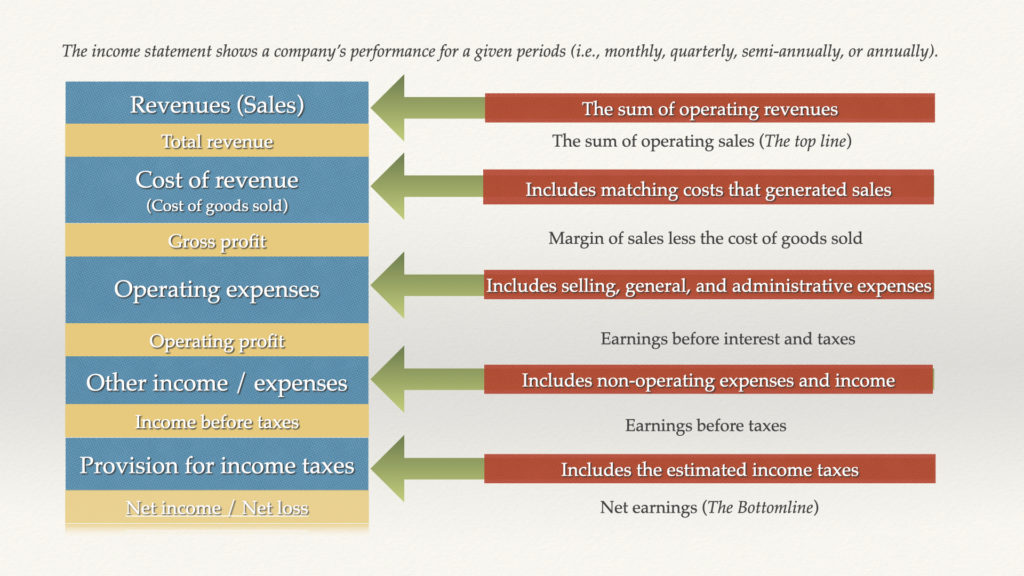

What is the income statement?

Above all, the income statement shows a company’s revenues and expenses. It is important for business owners and managers to understand the profit and loss. The P&L statement provides insights into a company’s profitability. Through financial accounting, you are able to determine how much earnings are generated by the company.

Revenue and expenses

Revenue is the money that a company earns through its operations. It is important for business owners and managers to understand the sources of revenue. It provides insights into a company’s profitability. Revenue can come from sales of products or services, interest income, royalties, or other sources.

The expense section of the income statement shows the money a company has spent over a specific period of time. It is important for business owners and managers to understand the expense section. It provides insights into a company’s profitability.

The P&L, or Profit and Loss statement, shows a company’s revenues and expenses during an accounting period. This accounting period can be monthly, quarterly, semi-annually, or annually. By understanding the P&L statement, business owners and managers can get insights into a company’s profitability. The income statement starts with revenues, which are then subtracted by the cost of goods sold (COGS). From there, operating expenses are subtracted to get the operating income.

Finally, other income and expenses are factored in to get the net income. The net income is the bottom line and tells you whether a company made a profit or loss during the accounting period. By regularly reviewing the P&L statement, business owners and managers can make informed decisions about how to improve their company’s financial performance.

Profitability analysis

Profitability ratios are a class of financial metrics that are used to assess a business’s ability to generate earnings relative to its operating costs and other expenses. In other words, these ratios show how much profit a company makes for every dollar of sales, accounting for both the cost of goods sold and all other operating expenses. There are many different profitability ratios, but the gross margin ratio, operating margin ratio, and net margin ratio are commonly used.

Companies use profitability ratios to benchmark their performance against others in their industry and track their own progress over time. For example, if a company’s gross margin ratio is declining, that could be a sign that its costs are rising faster than its revenue. Likewise, if a company’s operating margin ratio is increasing, that could be a sign of efficiency improvements.

While profitability ratios can be helpful in assessing a company’s overall health, it is important to remember that they only tell part of the story. They do not consider factors like the chosen accounting period or one-time items that can distort the numbers. As such, it is always important to consider profitability ratios in conjunction with other financial metrics.

What is the cash flow statement?

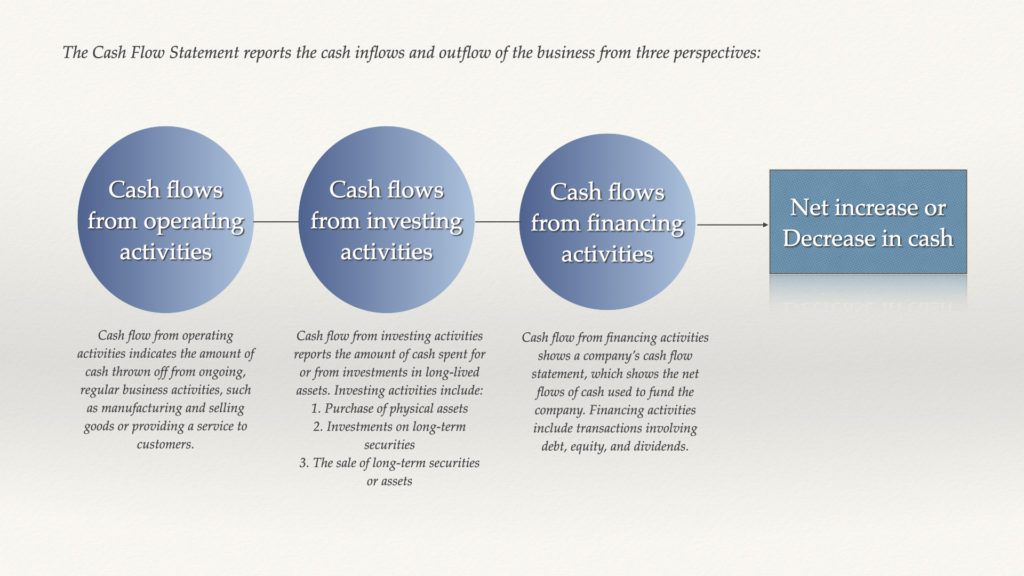

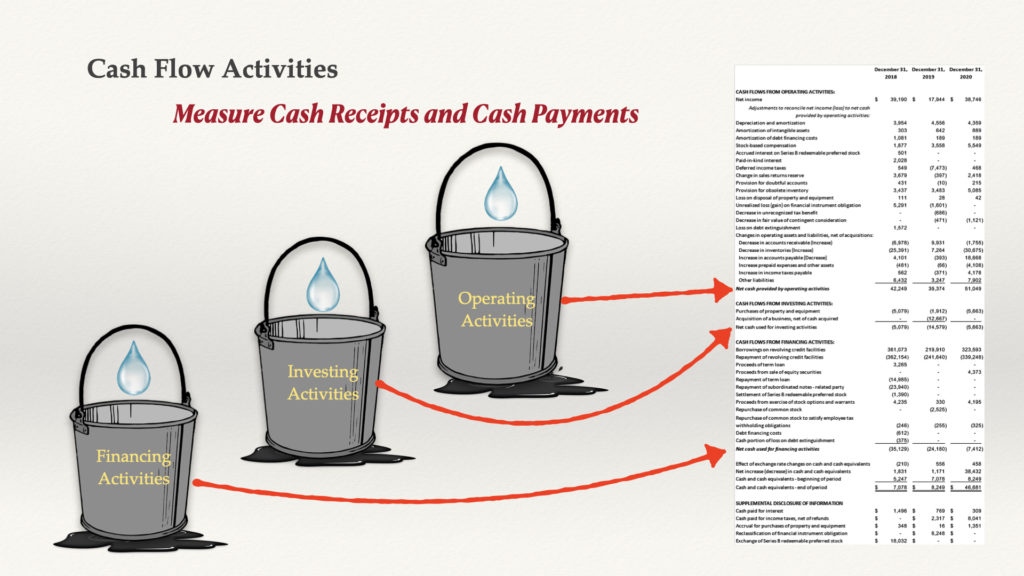

A financial statement shows how much cash a company has generated and used over the period. It is important for business owners and managers to understand how much cash flows are generated and how much cash is paid out. Consequently, it provides insights into a company’s liquidity.

Henceforth, the cash flow statement divides into the operating, investing, and financing sections.

Think of cash flows in turns of buckets

The operating section of cash activities shows the cash flow from a company’s operations. The investing section shows the cash activities paid out from a company’s investments. And the financing section shows the cash activities from a company’s financing.

Overall, A cash flow statement is one of the most important financial reports a company can provide. The activities function of the cash flow statement is to show how much cash a company has on hand and how much cash flows are coming in and going out. Therefore, this information is important for investors, creditors, and others who need to know the financial health of a company.

Henceforth, the cash flow statement allows the business owner to assess whether a company is generating enough cash to cover its expenses and debts. In general, a company that generates more cash than it is spending is considered financially healthy. There are several different metrics that can determine whether a company is in good financial health. But, two of the most important are the operating cash flow and the free cash flow.

Free cash flow

The operating cash flow is a measure of a company’s ability to generate cash from its core business activities, while the free cash flow measures the amount of cash that a company has available after it has paid for all of its expenses. Companies with a strong operating cash flow and a strong free cash flow are in good financial health.

Free cash flow is a company’s cash available after it has paid for all of its expenses. Cash thrown off pays dividends, make investments, or repurchase shares. Free cash flow calculates by subtracting the cash that a company has spent on operating expenses from the cash that it has generated from its core business activities.

Overall, a number of factors can affect a company’s cash flow, including its sales, expenses, and debt levels. Consequently, a company with high sales and high expenses may not be generating as much cash as it could be if it had lower expenses.

What is cash flow from the operating activities?

Cash from operating activities is the most crucial section of the cash flow statement. This section shows a company’s ability to generate cash from its operations. It is vital for business owners and managers to understand the cash flow from operating activities. Thus, it provides insights into a company’s liquidity.

The cash from the operating activities section shows the cash flow generated from a company’s operations. This section is vital for business owners and managers because it provides insights into its liquidity. The cash flow from operating activities can be positive or negative. Therefore, it is crucial to understand why it is positive or negative.

What is cash flow from the investment activities?

The cash activities from the investment section show the cash flow generated from a company’s investments. This section is essential for business owners and managers because it provides insights into its liquidity. The cash flow from investment activities can be positive or negative. Hence, it is crucial to understand why it is positive or negative.

What is cash flow from financing activities?

The cash from financing activities section shows the cash flow generated from a company’s financing. This section is essential for business owners and managers because it provides insights into its liquidity. Consequently, the positive or negative cash flow from financing activities enables you to understand the company’s performance.

What is the shareholders’ equity statement?

The shareholders’ equity statement is a financial statement that shows the changes in a company’s equity over time. It is important for business owners and managers to understand the shareholders’ equity statement. It provides insights into a company’s financial position.

Through the use of financial accounting, the shareholders’ equity statement can be positive or negative for a variety of reasons. A company’s shareholders’ equity can be positive if the company has generated more profits than dividends paid out. And, a company’s shareholders’ equity can also be positive due to raising capital from investors.

Overall, a company’s equity is vital to assessing its financial stability and performance. The equity statement, also known as the shareholders’ equity statement, reports the changes in equity of a company over time. This financial statement is essential for business owners and managers to understand as it provides insights into a company’s financial position.

Two common types of equity

There are two main types of equity: common equity and preferred equity. Common equity is what most people think of when they think of equity. The value of a company would be left over if all debts and other liabilities were paid off. Preferred equity is a type of equity that has a preference in terms of receiving dividends and liquidation proceeds.

Shareholders’ equity metrics

Several ratios and metrics exist to assess a company’s equity position.

The equity ratio is one metric that measures the amount of equity a company has concerning its total assets. This ratio is essential to assess because it shows how much cushion a company has to absorb losses. The equity-to-assets ratio calculates by dividing equity by total assets.

Another critical metric is the equity multiplier, which measures the amount of leverage a company uses. The equity multiplier calculates by dividing total assets by equity. A high equity multiplier means that a company uses more debt and less equity to finance its operations. The high equity multiplier can be risky because if the company experiences financial difficulties, it may have to sell assets to pay off its debts.

Audited, reviewed, and compiled financial statements

There are three different types of financial statements: audited, reviewed, and compiled. Audited financial statements are the most reliable because they’ve been looked at by an independent auditor. Reviewed financial statements are also pretty reliable because certified public accountants have looked them over. Compiled financial statements are the least reliable because someone just threw them together. So when a business owner is deciding on which type of a company’s financial statements you want, it’s important to know the level of assurance is received.

Audited financial statements

An audit is the most reliable type of financial statement because it means that an independent third party has looked at the books and verified that the information is reasonable.

Audited financial statements are important for a number of reasons. First, they provide assurance that the information contained therein is accurate and reliable. Second, they provide transparency into the financial affairs of a company, which can be helpful for investors and other interested parties. Finally, audited financial statements can help to prevent fraud and mismanagement by providing a detailed and unbiased view of a company’s financial situation.

Reviewed financial statements

A review is less reliable than an audit because the reviewer is not verifying the accuracy of the information, but is simply making sure that everything looks okay.

Like audited financial statements, reviewed financial statements are important for a number of reasons. First, they provide some assurance that the information contained therein is accurate and reliable. Second, they can provide transparency into the financial affairs of a company, which can be helpful for investors and other interested parties. Finally, reviewed financial statements can help to catch errors and prevent fraud or mismanagement.

Compiled Financial Statements

A compilation is the least reliable type of financial statement because the compiler is not verifying the accuracy of the information at all, they are simply putting it all together.

Compiled financial statements are important for a number of reasons. First, they can provide a quick and easy way to see a company’s financial situation. Second, they can be helpful for small businesses that may not have the resources to have their financial statements audited or reviewed. Finally, compiled financial statements can help to catch errors and prevent fraud or mismanagement.

Conclusion

A company pursues a number of business activities to obtain the business scorecard’s desired outcome. Business activities encompass planning, investing, financing, and operations. Overall, the scorecard allows for the development of strategy. Collectively, all statements synthesize into a cohesive scorecard, the financial statements, based on financial accounting. Remember, a certified public accountant put together the financial reports.

Finally, reviewing your company’s financial statements on a regular basis is essential for making informed decisions by business decision-makers. By understanding how your business is performing overall, you can identify areas that need improvement. This will enable you to make the necessary changes to ensure the future success of your company. This makes understanding accounting critical. Like playing any game, you must know how to read the scorecard to determine how well the company is doing. Additionally, with the use of management accounting systems (an internal use document), business owners need to read the financial statements to know what strategies to implement.

If you are a business owner, entrepreneur, or just need to know how to read financial statements, signup for my online course that is designed for you. My background will show you how I taught executive MBA students here, in China, and in India.