Essential tips entrepreneurs use to control costs in a high inflation environment.

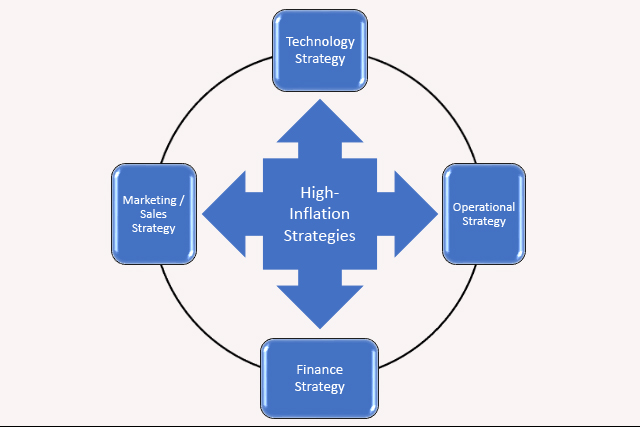

Well, hello there, my friends. I’m here to talk to you about the top 10 best high-inflation investment strategies entrepreneurs can use to control costs, especially in a high-inflation environment. Although Silicon Valley Bank imploded from the impact of inflation, higher prices more directly affect entrepreneurs. And since inflation can be a challenging time for small business owners, there exist strategies you can use to keep your costs down and your business running smoothly. Trust me. These are the best investment strategies during high inflation. So, without further ado, let’s dive in. #inflationstrategies #inflation #businessstrategies #businessownertips

Table of contents

Causes of high inflation

In recent years, the U.S. has experienced higher inflation levels than in previous years. The COVID-19 pandemic has significantly contributed to this trend, as it has disrupted supply chains, caused labor shortages, and increased demand for certain goods and services. Additionally, government stimulus measures, such as direct payments and expanded unemployment benefits, have also contributed to higher inflation.

The Federal Reserve has taken steps to raise interest rates to combat rising inflation. The Fed seeks to slow down borrowing and spending by raising interest rates, which can help reduce demand and ease inflationary pressures. The Federal Reserve has indicated that it will continue to closely monitor inflation levels and adjust interest rates as needed to maintain price stability and support economic growth.

Questions business owners should ask themselves?

- Are we closely monitoring inflation rates and their potential impact on our business and customers?

- Have we identified areas where we can control costs to offset the effects of high inflation, such as negotiating better deals with suppliers, optimizing pricing strategies, or reducing unnecessary expenses?

- Are we prepared to adjust our business model and strategies to adapt to changing economic conditions and consumer behavior in response to high inflation?

- Have we developed contingency plans to address potential supply chain disruptions or other challenges that may arise due to high inflation?

Challenges

As an entrepreneur, I know firsthand the challenges of running a successful business, especially during high inflation. With prices rising across the board, controlling costs and finding ways to save money without sacrificing quality is more important than ever. That’s why I’ve compiled a list of ten recommendations to help entrepreneurs stay profitable in any economic climate.

Knowing How to Prepare for High Inflation

Businesses must prepare for high inflation because inflation can significantly impact the economy, businesses, and consumers. Inflation is the rate at which the general level of prices for goods and services is rising, which means that the currency’s purchasing power is decreasing. This can lead to an increase in the cost of raw materials, production costs, and wages, affecting businesses’ profitability and leading to higher consumer prices.

When businesses are unprepared for high inflation, they may struggle to maintain their profit margins, leading to reduced investments, layoffs, or even bankruptcy. Companies that rely on imported goods or services may be particularly vulnerable to inflation because the prices of these items may increase due to currency fluctuations or supply chain disruptions.

Additionally, high inflation can lead to economic uncertainty and volatility, making it difficult for businesses to plan for the future. This can also affect consumer behavior, as they may reduce their spending or change their buying habits in response to higher prices.

Therefore, businesses must prepare for high inflation by implementing strategies to control costs, such as negotiating better deals with suppliers, reducing unnecessary expenses, or optimizing pricing strategies. By being proactive and preparing for high inflation, businesses can stay competitive, maintain their profit margins, and continue to provide quality products and services to their customers.

Operational Strategies

Negotiate better deals with your suppliers.

Firstly, during inflation, the cost of goods and services can rise, but you can negotiate better deals with your suppliers to help you save money. You can find cheaper alternatives or negotiate better payment terms. Building a good relationship with your suppliers can help you negotiate better deals.

Consider outsourcing.

Outsourcing can help you save money on labor costs, which can be a significant expense for small businesses. Taken as a whole, you can outsource tasks. Tasks include bookkeeping, marketing, or customer service to freelancers or other companies specializing in these areas. Outsourcing is the best investment strategy during high inflation to gain control over costs.

Cut unnecessary expenses.

Look at your expenses and identify areas where you can cut costs. Eliminating wasteful expenses could mean reducing your office space or switching to cheaper suppliers. Every penny counts when it costs to controlling costs.

Technology Strategies

Use technology to automate tasks.

Automating tasks like invoicing or inventory management can help you save time and money. You can use software like Quickbooks or Xero to automate your bookkeeping or inventory management software to help you keep track of your inventory. Technology is another best investment strategy during high inflation to improve profitability.

Control your inventory.

Keeping a close eye on your merchandise can help you avoid overstocking, which can tie up your cash flow. You can use inventory management software to help you keep track of your inventory and avoid overstocking.

Use energy-efficient equipment.

Energy costs can be a significant expense for businesses. Using energy-efficient equipment can help you save money on energy bills and reduce your carbon footprint.

Marketing and Sales Strategies

Optimize your pricing.

During times of high inflation, it’s essential to optimize your pricing. Revamping prices means finding the right balance between your costs and profit margin. You may need to adjust your pricing to reflect the rising costs of goods and services.

Utilize social media to market your business.

Social media can be a powerful marketing tool, often free or low-cost. You can use platforms like Facebook, Instagram, or Twitter to promote your business and attract new customers. Many find engaging social media to market the best investment strategy during high inflation for improved sales and brand expansion.

Focus on customer retention.

It’s often more expensive to attract new customers than retain existing ones. Focus on building solid relationships with your existing customers and providing excellent customer service to keep them returning.

Financing Strategies

Consider alternative financing options.

Traditional financing options like bank loans can take more work during high inflation. Consider alternative financing options like crowdfunding or peer-to-peer lending to help raise funds needed to grow your business.

Thus, these recommendations help you control costs and keep your business running smoothly during high inflation. Every penny counts, and you can weather any economic storm with creativity and hard work.

In Summary

In conclusion, controlling costs requires using the best investment strategies during high inflation is essential for black entrepreneurs, especially during high inflation. Entrepreneurs can stay competitive and profitable by negotiating with suppliers, outsourcing tasks, automating tasks, cutting expenses, managing inventory, adjusting pricing strategies, using social media marketing, retaining customers, using energy-efficient equipment, and investing in employee training. These recommendations are helpful for your business.