Table of contents

Why Break down the income statement?

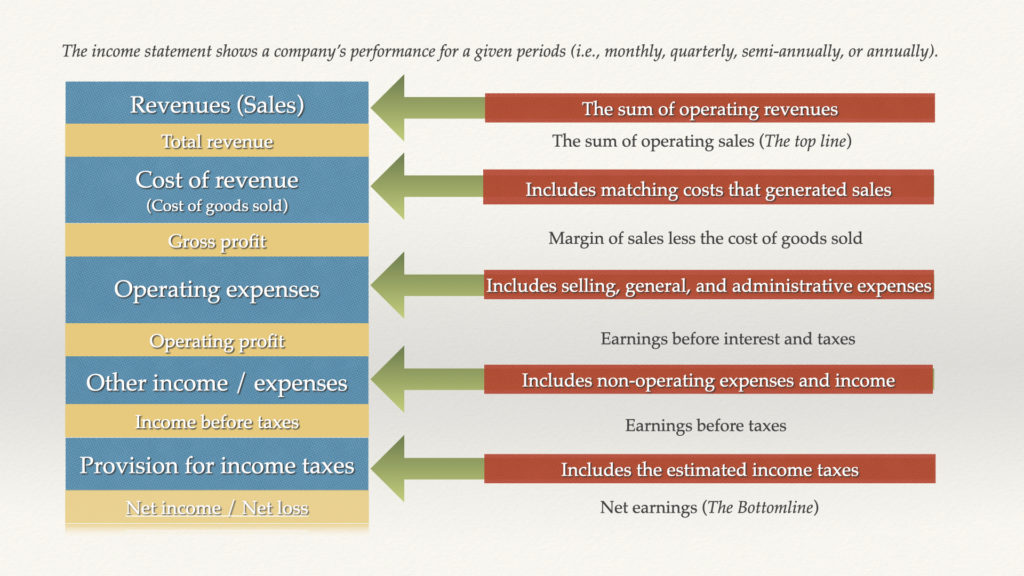

The income statement is one of the most important financial statements. Breaking down the income statement shows the profitability of the company during a specific period. The income statement starts with revenues and then deducts all expenses to arrive at net income. The statement includes sales, cost of goods sold, operating expenses, and other income or expenses. The most common method used to report the income statement is accrual basis accounting. This method recognizes revenue when earned and expenses when incurred. The income statement is prepared monthly, quarterly, or annual. Overall, the income statement is a financial scorecard. Understanding income statements are critical.

Sales or Revenue

Nothing stands still, but either you “grow or die” when talking about company sales. We expect a company’s sales to grow. We also call sales the “topline.” Sales or revenue consist of a company’s total amount of money from its sales activities. Measuring revenue growth is one of the first steps we look at to determine how well a company is doing. Whether we are satisfied with the company’s products or services.

The sales section of the income statement is a report of a company’s revenue during a specific period. This information is used to calculate the net income of the company. The sales section includes all revenues from the sale of goods and services and any other income, such as interest and dividends, depending on the reported format used. Sales are reported after deducting returns or discounts. Understanding the sales section of the income statement can be a helpful tool for investors to assess a company’s financial health. It can also be used by managers to track revenue and identify trends.

Cost of Sales or Cost of Goods Sold (COGS)

The cost of sales or goods sold encompasses the amount of money a company spends on costs associated with producing sales of inventoriable costs, inventories, or services.

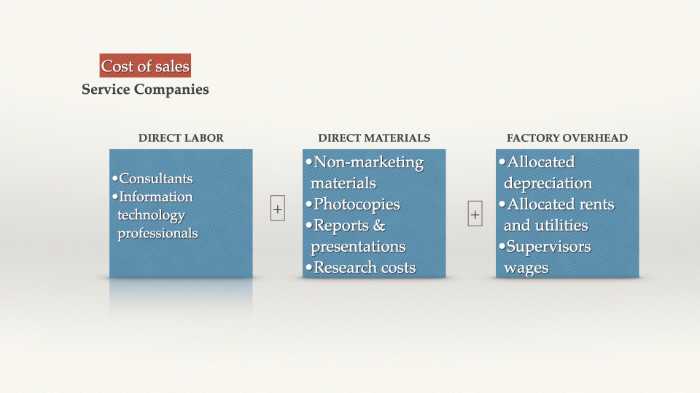

Cost of sales – Services companies

When it comes to service companies that do not sell goods, the cost of sales is analogous to manufacturing companies, i.e., direct labor, direct materials, and overhead. The cost of sales for a service company can vary widely depending on several factors. The service type can impact costs, with more expensive or specialized services tending to come at a higher price point. In addition, staffing costs and overhead expenses can have a major impact on the overall costs of sales. Meanwhile, different market strategies and advertising tactics can also play a significant role in determining how much each sale racks up in terms of cost. Ultimately, any company looking to survive and thrive in the highly competitive world of selling services will need to pay careful attention to the various factors that go into calculating the cost of sales for their particular business model.

Cost of sales (COS)- Retail Company

A retail company’s cost of sales, also known as cost of goods sold (COGS), are all the costs related to purchasing the merchandise that the company sells to its customers. Retail COS would include the cost of the actual goods, any shipping charges paid to get the merchandise to the store, and any handling fees charged by the supplier.

To figure out their COGS, retailers must keep track of these different expenses. Retailers typically want their COGS to be as low as possible to increase their profits. However, lowering COGS can be difficult if the company also wants to maintain a high level of customer service. For example, a retailer might choose to reduce their COGS by switching to a cheaper but less reputable supplier. High COS could lead to problems down the line if the new merchandise is not up to the same quality standards as what the company previously sold. As a result, retailers need to balance keeping their COGS low and providing their customers with high-quality products.

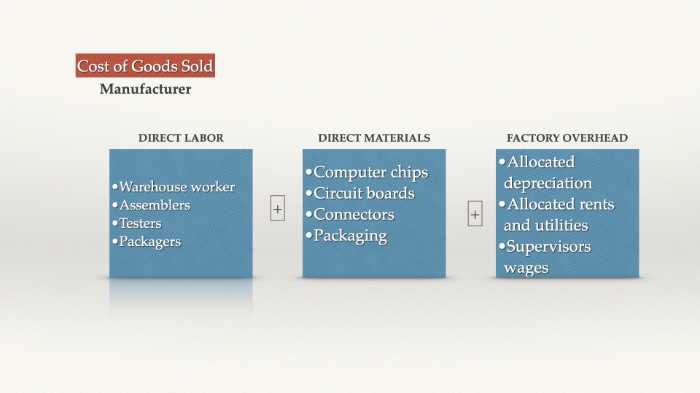

Cost of goods sold – Manufacturing Company

The cost of goods sold for a manufacturing concern includes direct labor, material, and overhead costs:

- Direct labor includes the cost of the wages paid to employees who work directly on producing the product or service.

- Direct materials encompass the costs of the raw materials used in the production process.

- And factory overhead captures the cost of all indirect expenses allocated to the cost of sales, including rent, utilities, supervisor salaries and benefits, insurance, and depreciation expense of assets.

The three costs are inventoriable costs directly related to the specific sales or services sold that make up sales.

Cost of goods sold as a percent of sales

Gross profit is the amount of profit left over after inventory costs associated with producing the company’s products, or services are used relative to sales.

Measuring gross profit is critical because it can determine the success or failure of the company. A company must have a healthy gross profit margin to cover operating expenses. When measured as a percent of sales from period to period is one way to determine whether inventory costs are a problem.

Gross margin or gross profit margin

The gross margin or gross profit margin is the percentage of sales after deducting the cost of goods sold. The higher the ratio, the more profitable the company is. This figure is used to evaluate profitability and efficiency and determine whether a company has enough money left over to cover its other expenses such as operating expenses.

Gross margin = (Revenue – COGS) / Revenue

Losses are expected if the gross margin is too thin.

Operating expenses

The operating expense section is one of the most critical aspects of any business. This is because it encompasses all of the essential selling, general, and administrating (SG&A) expenses that are necessary to keep a company running smoothly day in and day out.

Operating expenses include everything from marketing and advertising costs to employee salaries and benefits. In addition, the operating expense section typically includes expenses and the cost to operate and manage the business over and above the cost of the products and services sold to customers. We are talking about management salaries and the cost of rent for office space.

All costs to marketing and sales and other administrative costs are included. Ultimately, this means that all businesses must carefully monitor their operating expenses to ensure that they have adequate resources to support continued growth and profitability. After all, if SG&A costs get out of control, they can quickly eat into a company’s margins, putting its long-term financial stability at risk. So if you’re looking to succeed in business, be sure to pay close attention to your company’s operating expenses!

Operating Income = Gross profit – Operating Expenses

Operating expense does not include non-operating income and expenses. Earnings, before interest, taxes.

Other income and expenses

Other non-operating income and expenses on the income statements include items that are not related to the company’s primary operations. These include foreign currency gains or losses and write-offs of bad debts.

Income taxes

The income tax provision is the amount of taxes that a company expects to pay in the current year on the taxable income generated by its operations. The figure is calculated by multiplying the company’s estimated taxable income by its expected effective tax rate for a given period.

Income from continuing operations

Income from continuing operations is the profit that a company generates from its core business activities over a given period of time. Unlike reported net income, which can include items like discontinued operations and extraordinary gains or losses, the measure of income from continuing operations only includes earnings generated by ongoing business activities.

Net income

Called the bottom line or net profit, net income portrays the profit generated by a business.

How do we analyze the income statement?

A number of ways exist in analyzing the income statement.

- One way is to compare the company’s gross margin percentage from one period to another. This will give you an idea of how well the company is controlling its costs.

- Another way to analyze the income statement is to calculate the company’s operating expense ratio. The ratio tells you the percentage of the company’s revenue spent on operating expenses.

- You can also calculate the company’s earnings before interest and taxes (EBIT) margin. This margin tells you how much profit the company is making before it has to pay taxes and interest on its debt.

- Finally, you can look at the company’s net income to assess its overall profitability and financial health. This figure will tell you how much profit the company has made after accounting for all expenses, including taxes, interest, and other non-operating items.

Overall, there are many different ways to analyze a company’s income statement in order to gain insight into its financial health and profitability. By carefully reviewing this important financial document, you can better understand how well a company is performing and what areas may need improvement.

In Conclusion

The income statement or P&L is one of the most important financial statements. It provides insights into a company’s profitability and financial health. By carefully analyzing this document, you can better understand how well a company is performing and what areas may need improvement. It is critical that you know how to read and interpret financial statements. And knowing the importance of income statements is essential.

Key Takeaways

- The Income Statement also called the Profit and Loss Statement (P&L), is a financial document that reports a company’s revenues, expenses, and profits over a given time.

- The Income Statement is crucial because it provides insights into a company’s profitability.

FAQs

What is an Income Statement?

An income statement is a financial statement that summarizes a company’s revenues, expenses, and profits/losses over a certain period.

How can I use an income statement to assess a company’s financial health?

There are many different ways to analyze an income statement. One way is to compare the company’s gross margin percentage from one period to another. This will give you an idea of how well the company is controlling its costs. Another way to analyze the Income Statement is to calculate the company’s operating expense ratio. This ratio will tell you what percentage of the company’s revenue is spent on operating expenses. You can also calculate the company’s earnings before interest and taxes (EBIT) margin. Margin tells you how much profit the company’s making before it has to pay taxes and interest on the debt. Finally, you can look at the company’s net income to assess its overall profitability and financial health. The figure will tell you how much profit the company has made after all expenses.

What are some of the most critical income statement ratios?

The essential Income Statement ratios include gross margin percentage, operating expense ratio, and earnings before interest and taxes (EBIT) margin.

By looking at these ratios, you can gain valuable insights into a company’s performance and financial health.

Is the Income Statement the only financial statement that businesses use?

No, there are other important financial statements that businesses use in addition to their income statements. These include balance sheets, cash flow statements, and other types of financial reports. By understanding how the financial statements work together, you can get a complete picture of a company’s finances and performance.

Courses Designed for You

Read the financial statements through:

Understanding the balance sheet, income statement, and cash flow statement, even if you have no experience with financial statements.

Interpret financial statements through:

Analyzing financial statements using profitability ratios i.e., Gross Margin (Cost of Goods Sold / Revenue), Operating Margin (EBITDA/ Revenue), Net Profit Margin (Net Income / Revenue), Return on Assets (Net Income / Assets), and Return on Equity (Net Income / Equity).

Gary Rushin is a certified public accountant. With over 40 years of experience, Gary Rushin’s depth and breadth of experience include investment and commercial banking, business insolvency and turnaround professional, and teaching executive MBA programs to name a few. Most recently, Gary successfully turnaround an insolvent 70-year-old manufacturing company winning numerous awards.