Tips for Reading and Interpreting Financial Statements

Table of contents

- Tips for Reading and Interpreting Financial Statements

- Reading Financial Statements is Essential

- How Are Financial Statements Used?

- The Difference Between Cash and Accrual Accounting

- What are the Critical Parts of the Financial Statements?

- How to Read and Interpret the Balance Sheet?

- Key Indicators to Determine

- Balance Sheet Breakdown

- How to Read and Interpret the Income Statement?

- How to Read and Interpret the Cash Flow Statements

- In Conclusion

As a business owner, financial literacy is essential to feel in control of your finances and make choices that will lead to greater life satisfaction. Financial statements track income and expenses, assess spent money, and set financial goals. In addition, financial literacy can help you understand investment options, retirement planning, and estate planning. By understanding your finances, you can make informed decisions that lead to financial security and a greater sense of well-being.

Reading Financial Statements is Essential

If you are a small business owner, one of the essential skills is knowing how to read and understand financial statements. Financial statements show you where your company stands financially in real-time. They tell you what’s working and what isn’t in your business so that you can run it more efficiently and strategically grow it into something much bigger! This blog post will go over the tips that will help any small business owner learn how to read and interpret financial statements for their purposes.

How Are Financial Statements Used?

Financial statements help small business owners run their businesses by providing essential insights into what’s working and where they need to make changes for better results. They allow entrepreneurs to make informed decisions using real-time data related to revenue performance, operating costs, inventory/assets used, etc. The income statement, balance sheet, and cash flow statement.

The Difference Between Cash and Accrual Accounting

Two accounting methods exist cash accounting and accrual accounting. The critical difference impacts revenue and expense recognition.

- Cash Accounting recognizes revenue upon cash receipt and expenses when the company pays. This method is simpler to understand but does not provide a complete picture of the company’s financial health because it does not consider unpaid bills or invoices.

- Accrual Accounting recognizes revenue when earned and expenses incurred, regardless of whether or not the receipt of money. Accrual accounting provides a more accurate view of a company’s financial position as it includes both assets (invoices that have been sent but not yet paid) and liabilities (unpaid bills). It is the preferred method of accounting as it paints a more accurate picture, but it can be more complicated to understand.

What are the Critical Parts of the Financial Statements?

Understand financial statements. There are three main statements: the income statement, balance sheet, and cash flow. Reading these parts will give you a general idea of how your company has performed financially over time or within certain months or years.

Also, the footnotes to the financial statements provide details about specific line items in each part of an organization’s financials and are critical to understanding the numbers.

- The Income Statement shows how much money your company has earned over a specific period. It will tell you what revenues and expenses have contributed to that profit or loss.

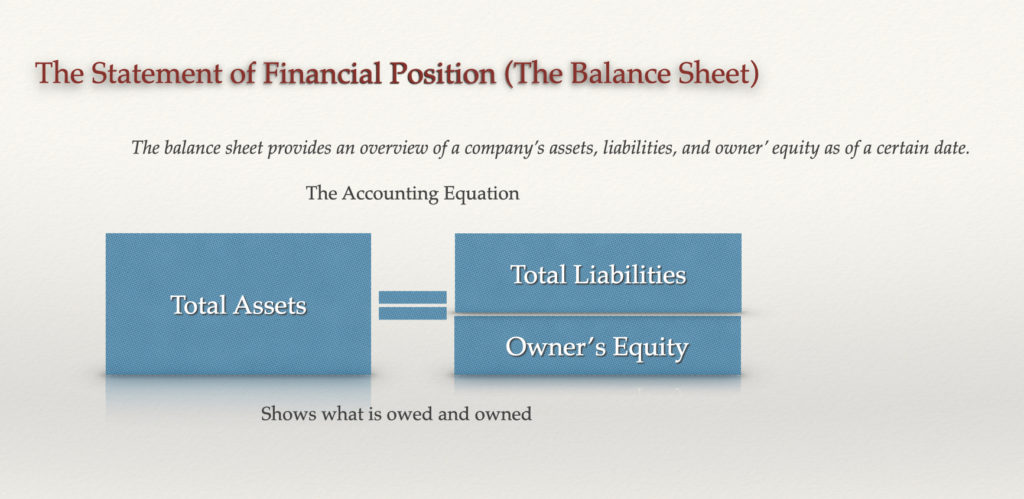

- The Balance Sheet is a snapshot of your company’s financial position at a given time. It lists all of your assets (money, equipment, inventory, etc.), liabilities (debts and other obligations), and shareholder equity (the total value of the business).

- The Cash Flow Statement tells you where your cash is coming from and going over a specific time. The cash flow statement enables you to understand whether or not your company has enough money on hand to cover expenses.

How to Read and Interpret the Balance Sheet?

Now that you understand the different parts of financial statements, let’s look at the balance sheet. The balance sheet lists all of your company’s assets (money, equipment, inventory, etc.), liabilities (debts and other obligations), and shareholder equity (the total value of the business).

Assets are on the left-hand side, and liabilities and shareholders’ equity are on the right-hand side. Once you have identified the section, you can start to read and interpret the information.

Key Indicators to Determine

Here are four things to look for when reading a balance sheet:

- Liquidity measures how easily an asset converts into cash.

- Leverage measures how much debt a company has compared to its equity. The higher the leverage amount, the more risk exists.

- Solvency measures how likely a company is to be able to pay its debts over time. The higher the solvency, the more likely a company is to be able to repay its debts.

- Profitability measures how profitable a company is. The higher the profitability, the more money a company makes.

The balance sheet can provide helpful insights into a company’s financial position and help you make intelligent decisions about your business. By understanding what to look for, you can better assess a company’s financial stability and make sound judgments about whether or not to invest in it.

Balance Sheet Breakdown

The balance sheet is one of business owners’ most important financial statements. It lists all your company’s assets, liabilities, and shareholder equity. The first step is to identify which section line items appear on the balance sheet. Total assets are on the left-hand side, and liabilities and shareholders’ equity are on the right-hand side. The balance sheet follows the accounting equation: Assets = liabilities + owners’ equity.

Once you have identified the section, you can start to read and interpret the information.

The Assets Section

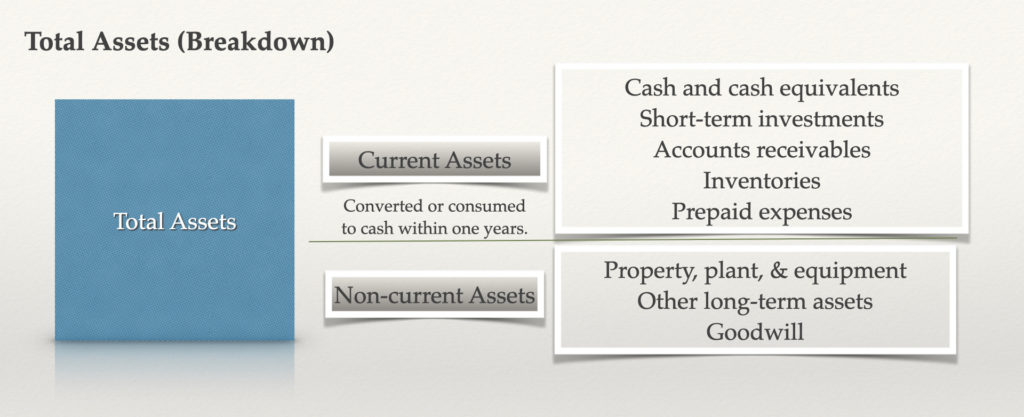

Assets represent all resources owned by the company. The most common types of assets include:

Current assets (short-term resources used within one year)

- Cash includes currencies, coins, checking accounts, savings accounts, and near-money. It also includes bank guarantees you may have issued as security against deposits or loans with another party (such as customer balances). If an asset falls into more than one category (which often happens), list them under whichever heading is most appropriate.

- Marketable securities include investment in bonds, treasury bills, notes, and common stock of other companies. Marketable securities can easily be converted into cash or held until maturity to receive interest or a return on principle. Note that marketable securities should only include items you would not reasonably expect to use quickly (i.e., at least within a year).

- Accounts receivable arise when selling products based on the customer to pay later.

- Inventory includes inventory available for sale in the finished form and “work-in-process” inventory, which encompasses goods on hand before they reach their completion stage.

Long-term assets (long-term resources used past one year)

- Property, plant, and equipment – Also known as fixed assets, these are assets acquired for use in the business’s operations. Other than land, fixed assets depreciate over their expected lives.

The Liabilities Section

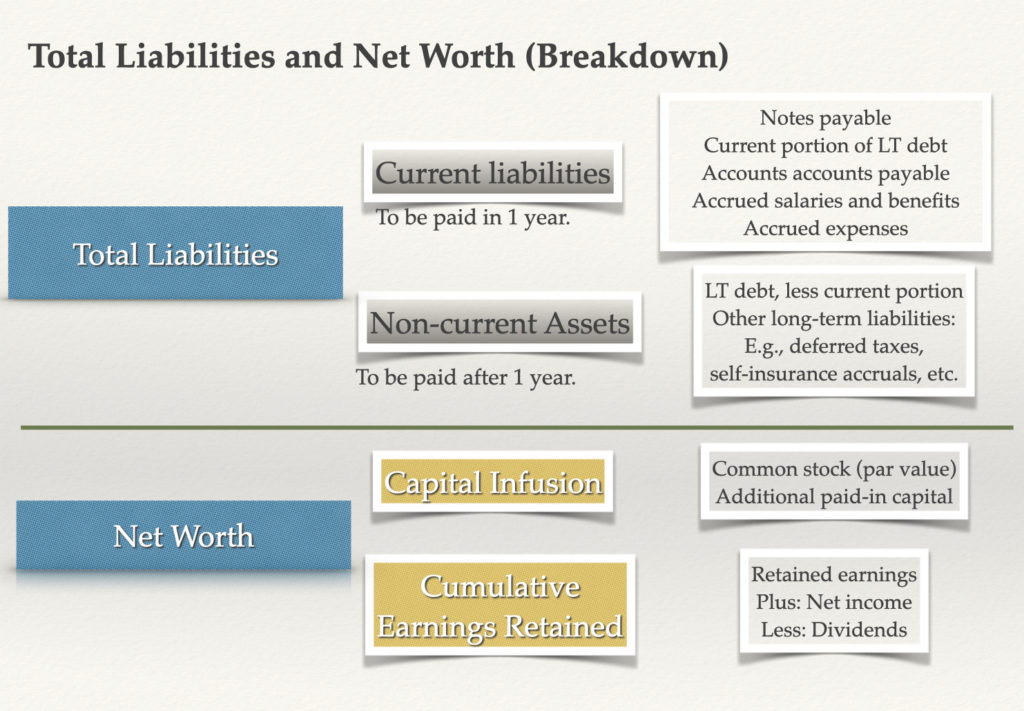

Liabilities represent what you owe and can come due within one year, while equity represents the owners’ interest in the company’s net assets after deducting liabilities from its total assets:

Current liabilities (obligations owed within one year)

- Accounts payable – This is what the business owes to suppliers for products and services received but yet to pay.

- Accrued expenses are costs incurred by the company but unpaid (e.g., wages owed, rent due).

- Loans and borrowings – This includes any money the company borrowed from a bank or other lending institution and the current portion of long-term debt payments (those made within one year).

Long-term liabilities (obligations owed more than one year)

- Long-term debt is long-term obligations borrowed from external parties.

The Equity Section

Shareholder’s equity includes the shareholders’ original investment in the business plus profits (or minus losses) earned since then. Unfortunately. the shareholders’ equity statement does not include money that has been loaned to the company by shareholders. Such loans appear in loans and borrowings, not as shareholder’s equity.

- Capital stock (also known as “share capital”) represents the shareholders’ ownership.

- Retained earnings represent accumulated profits (net dividends paid) or residual earnings.

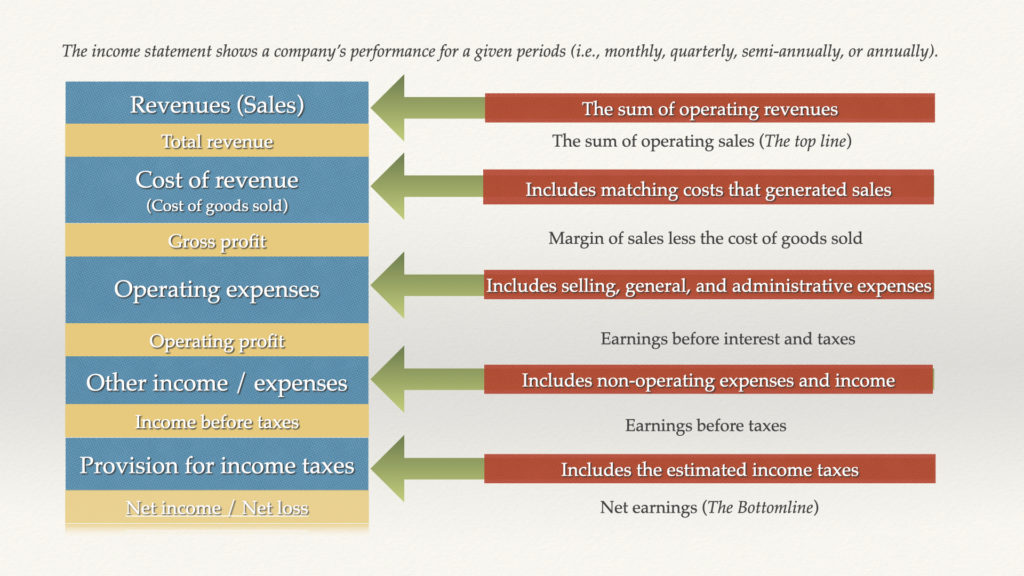

How to Read and Interpret the Income Statement?

The income statement measures the business’s financial performance and how well it is doing.

Different sections of the income statement

There are different types of costs you will see on an income statement, including:

- Gross profit shows how much money a company makes from its sales minus any direct production or purchase costs associated with those goods. Also known as the gross profit margin, the gross margin reflects a percentage of revenue (gross margin = gross profit/revenue). Gross margins vary widely by industry.

- Operating profit includes profits after selling, general administrative, research & development, interest expense, etc. Operating expenses capture all costs relating to the ordinary business operations of the business.

- EBITDA – Earnings Before Interest, Taxes, Depreciation, and Amortization measures a company’s operating performance without the impact of these four expenses. EBITDA can help understand how profitable a company is before paying any interest or tax. Banks and investors usually discuss EBITDA and a cash flow indicator. You will have to calculate EBITDA manually.

- Earnings before taxes exclude non-operating income and expenses from operating profit.

- Earnings, also known as the bottom-line or net income, show the company’s profitability.

The income statement can help you understand how well your business is doing financially. The statement identifies areas where you could improve. By understanding the different types of costs on an income statement, you can make better decisions about your business operations. The income statement is one of business owners’ most important financial statements. The income statement shows how much money a company makes from its sales minus any direct production.

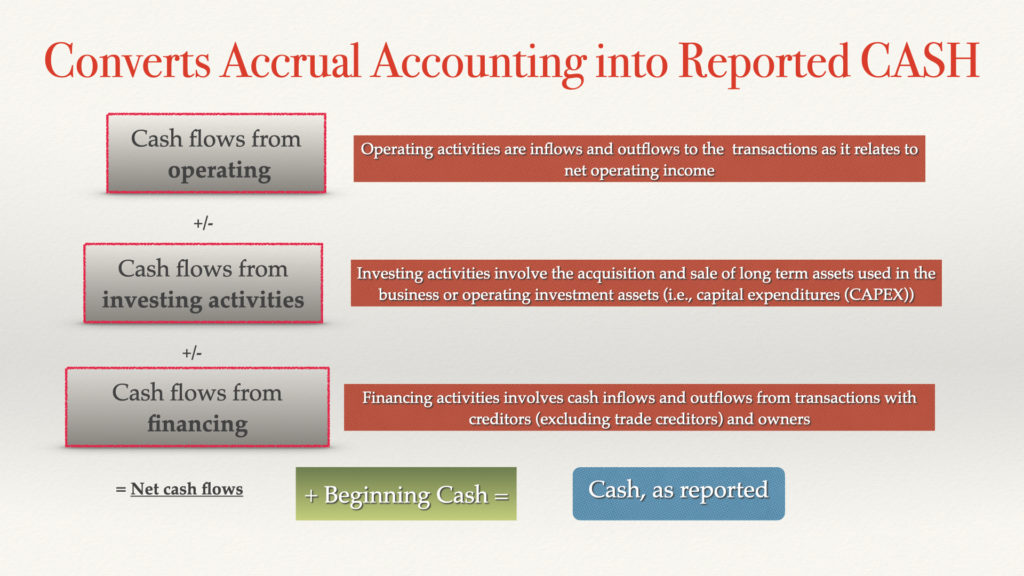

How to Read and Interpret the Cash Flow Statements

The cash flow statement is one of the most important financial statements for any business. Consequently, the cash flow statements provide insights into a company’s liquidity, solvency, and overall financial health. It measures changes in a business’ cash balance from one year to the next. Henceforth, the statement can be used to help you make sound strategic decisions about how to grow your company.

There are three main sections on the cash flow statement – operating activities, investing activities, and financing activities. The first two deal with how the cash is generated or spent by the business. And the third looks at where that money came from (i.e., equity, loans, etc.).

Tips for reading the cash flow statement

Here are some tips for reading and interpreting the cash flow statement:

- Operating activities show cash generated from your company’s core business operations; it shows how much money was generated or spent during the ordinary course of doing business. It also reflects changes in accounts such as inventory and receivables. Operating activities will impact cash flow (for better or for worse).

- Investing activities show what money you put into new buildings, equipment, and other capital expenditures.

- Financing activities show how the company raised or spent its cash. Financial activities include whether it was through issuing new shares, taking on new debt, or making payments on loans.

- Read and understand the cash flow statement. You can gain valuable insights into a company’s past, present, and future cash movement. Use this information to make intelligent decisions about growing the business!

In Conclusion

The financial statements are a snapshot of your business’s health, so reading and understanding them is essential. If you’re looking for more help with reading the numbers on your balance sheet, let us know! Our team can help you make sense of the income statement, cash flow statement, and others. You can best evaluate where your business stands financially by knowing the numbers. We want to provide you with all the tools available to take control of your finances. Don’t be afraid to reach out if this sounds like something that would be useful!