How does an analysis of financial statements impacts decision-making?

Table of contents

- How does an analysis of financial statements impacts decision-making?

- The importance of financial statement analysis

- Introduction to financial statement analysis

- Types of Financial Statement Analysis

- Ratio Analysis

- What are the benefits of financial statement analysis?

- Problems with Financial Statement Analysis

- Summary of financial statement analysis

- FAQs

The importance of financial statement analysis

When I was a financial analyst, I always loved reading companies’ financial statements. Each statement tells its own little story about how the company is doing financially. The income statement shows how much money the company made and spent over a period of time. The balance sheet shows the company’s money at any moment. And the cash flow statement shows how the company’s money moves in and out over time. This article answers how does an analysis of financial statements impact decision-makers?

The statements tell a story

Together, these three statements tell the full story of a company’s finances. They show both the good and bad aspects of a company’s performance. An analysis of these statements can help investors, employees, and other interested parties make informed decisions about a company.

There once was a company that was doing really well. They had a great income statement, with lots of revenue and profit. However, their balance sheet wasn’t looking so good. They had a lot of debt and not much in the way of assets. And their cash flow statement wasn’t looking too good either- they were spending more money than they were making.

So what happened to this company? Well, eventually they went bankrupt. Their debt overwhelmed them and they couldn’t keep up with their expenses. Financial statement analysis is important because it tells you the story of a company’s financial health. This company’s income statement looked great, but its balance sheet and cash flow statement showed that they were in trouble. So if you’re thinking about investing in a company, be sure to look at all three of its financial statements!

Introduction to financial statement analysis

Financial statement analysis is the examination of financial information to reach business decisions. This analysis typically involves an examination of both historical and projected profitability, cash flows, and risk. It may result in the reallocation of resources to or from a business or a specific internal operation.

The outcome of financial analysis may be any of these decisions:

- Whether to invest in a business and at what price.

- Whether to lend money to a business and if so, what terms to offer.

- Whether to invest internally in an asset or working capital and how to finance it.

Financial statement analysis is important because it provides insights that can help make sound investment decisions. For example, analysts may use financial statement analysis to assess a company’s future profitability or to identify potential red flags that could indicate financial trouble.

And, financial statement analysis uses various methods. Some of the most common include ratio analysis, trend analysis, and comparative analysis.

How can I analyze financial statements?

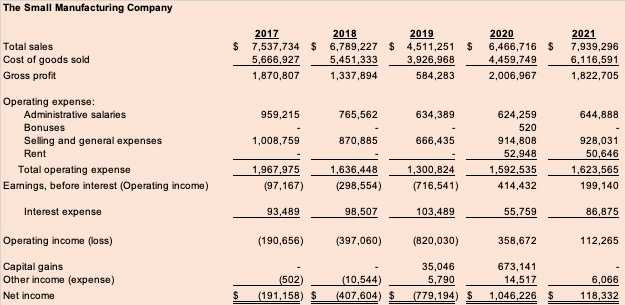

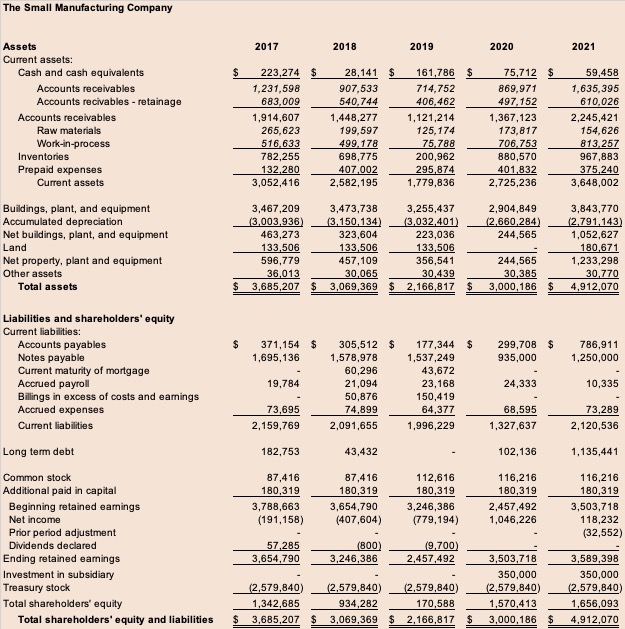

Financial records are important records for all aspects of the operation. The evaluation of Income Statement and Balance Sheet indicators will take into account past, present, and projected performances. In the United States, financial statements are based on financial principles called generally, accepted financial principles (GAAP). The following provides techniques of financial analysis.

The trend Analysis

Trend analysis is another type of financial statement analysis that involves looking at how line items on financial statements have changed over time. Overall, trend analysis assesses whether a company is improving or deteriorating financially.

Types of Financial Statement Analysis

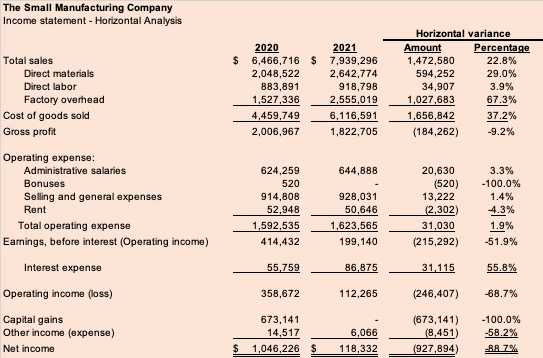

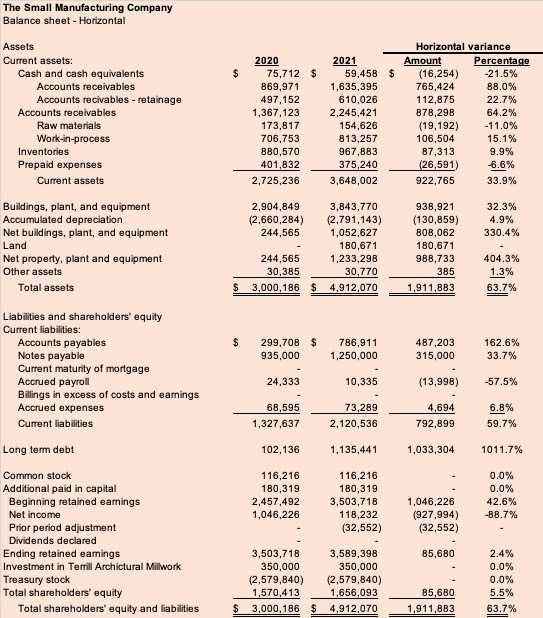

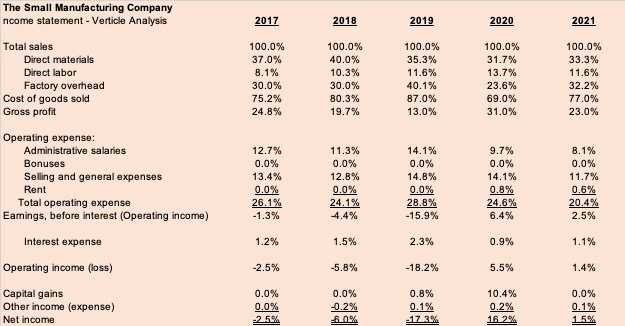

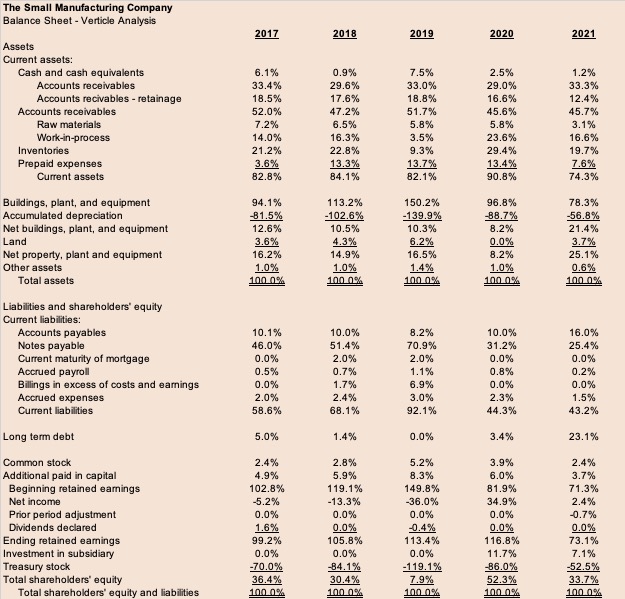

Financial statement analysis uses two key techniques to evaluate an underlying financial statement. This first technique involves horizontal and vertical analysis. The horizontal analysis involves comparing financial information across a set of reporting periods, vertical analysis is a comparative analysis comparing a financial report. In a typical example, this will be the difference between a percentage of revenue and a percentage of total income for a line item on the balance sheet.

Additionally, a comparative analysis assesses company one company against two or more similar companies. Financial statement analysis evaluates a company’s overall financial health, as well as identifies potential red flags that could indicate financial trouble.

Horizontal analysis

Horizontal analysis is an examination of financial information across a set of reporting periods. This means that you are looking at how a company’s financial position has changed over time. To do this, you will need to compare financial statements from different points in time.

One of the benefits of horizontal analysis is that it can help you to identify trends. For example, if you see that a company’s revenue has been increasing steadily over the past few years, this may be an indication that the business is doing well. On the other hand, if you see that a company’s expenses have been increasing at a faster rate than its revenue, this could be a sign that the business is in financial trouble.

Horizontal analysis compares a company’s financial information to that of its competitors. This can be helpful in assessing a company’s relative financial strength.

Vertical analysis

A vertical analysis is a comparative analysis that compares a financial report to itself over time. This means that you are looking at how a company’s financial position has changed over time. To do this, you will need to compare financial statements from different points in time.

One of the benefits of vertical analysis is that it can help you to identify trends. For example, if you see that a company’s revenue has been increasing steadily over the past few years, this may be an indication that the business is doing well. On the other hand, if you see that a company’s expenses have been increasing at a faster rate than its revenue, this could be a sign that the business is in financial trouble.

A vertical analysis compares a company’s financial information to that of its competitors. This can be helpful in assessing a company’s relative financial strength.

Comparative analysis

Additionally, a comparative analysis is an examination of financial information from two or more companies. This means that you are looking at how different companies’ financial positions compare to each other. This can be helpful in assessing a company’s relative financial strength.

One of the benefits of a comparative analysis is that it can help you to identify trends. For example, if you see that one company’s revenue has been increasing steadily while another company’s revenue has been decreasing, this may be an indication that the first company is doing better than the second.

Consequently, a comparative analysis evaluates a company’s financial information to that of its competitors. This can be helpful in assessing a company’s relative financial strength.

A powerful tool for decision-making

Financial statement analysis is a powerful tool that impacts decision-making in a number of different ways. By carefully examining a company’s financial statements, you can gain valuable insights into its financial health and performance. This information is used to make decisions about whether or not to invest in a company and enables you to assess a company’s relative financial strength. Financial statement analysis is an essential tool for any investor or business decision-maker.

Ratio Analysis

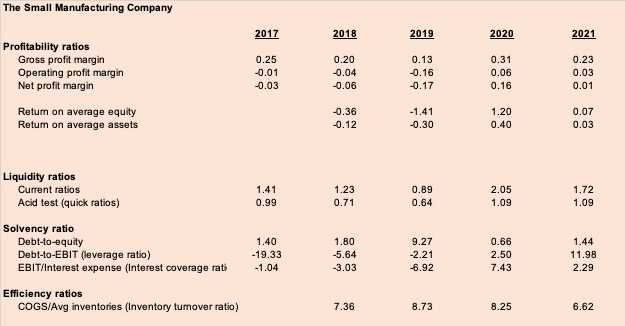

Ratio analysis is a type of financial statement analysis that involves comparing line items on financial statements to reveal important information about a company. Financial ratios assess a wide range of aspects of a business, including profitability, liquidity, solvency, and efficiency.

Profitability ratios

Profitability ratios measure how well a company is doing. There are many ratios, but the most common ones are the profit margin, return on assets, and return on equity. The profit margin measures how much of each dollar of revenue a company keeps as profit. The higher the margin, the more profitable the company is. The return on assets measures how much profit a company makes for each dollar of assets it has. The higher the return, the more efficient the company is. The return on equity measures how much profit a company makes for each dollar of shareholder equity. The higher the return, the better the company is at using shareholders’ money to generate profits. All of these ratios are important metrics for determining how well a company is doing.

Liquidity ratios

Liquidity ratios are important tools that investors, creditors, and other financial statement users can use to make better-informed decisions. Ratios compare companies of different sizes and different ratios can of companies within the same industry. Liquidity ratios provide information about a company’s ability to pay its short-term obligations. The most common liquidity ratios are the current ratio and the quick ratio. The current ratio divides current assets by current liabilities. Additionally, the quick ratio divides quick assets (cash and accounts receivables) by current liabilities. Quick assets easily convert to cash.

Creditors often use liquidity ratios to assess a company’s creditworthiness. For example, if a company has a current ratio of less than 1, it may have difficulty meeting its short-term obligations. Likewise, if a company has a quick ratio of less than 1, it may not have enough liquid assets to cover its short-term obligations. Such ratios provide valuable insights into a company’s financial condition.

Solvency ratios

Solvency ratios are one of the most important ways that investors and analysts judge company performance. The ratios provide a way to compare different aspects of a company’s business, such as sales and expenses, or debt and equity. Solvency ratios compare a company’s performance to its peers or to the overall market. Overall, solvency ratios are an essential tool for making investment decisions. Consequently, different ratios assess a company, but some of the most important ratios include the following:

- The current ratio measures a company’s ability to pay its short-term debts with its current assets. A ratio of 1.5 or higher is good.

- The debt-to-equity ratio measures a company’s financial leverage. A ratio of 0.5 or lower is excellent.

- The profit margin measures a company’s ability to generate profits from its sales. A margin of 5% or higher is healthy.

- The return on equity measures a company’s ability to generate profits for shareholders. A return of 15% or higher is excellent.

Measures the equity position

Solvency ratios are tools that investors and analysts use to judge company performance. However keep in mind, that solvency ratios measure how much equity supports a company’s assets. Consequently, these ratios are important because they provide insights into a company’s financial health and its ability to meet its obligations. And the ratios evaluate a company’s ability to stay in business, which is its ability to pay its debts as they come due. Additionally, solvency ratios assess a company’s financial performance. Often, these ratios compare a company’s financial ratios with those of other companies in its industry as well as compare a company’s ratios with the ratios of companies in different industries.

Efficiency ratios

Efficiency ratios are a financial tool companies use to measure how well they use their resources. The efficiency ratio divides a company’s operating expenses by its total revenue. Each of these ratios measures different aspects of a company’s operations, and they can all give insights into how well a company is doing. By looking at efficiency ratios, investors and analysts assess a company’s financial health.

Efficiency ratios are one way to measure how well a company is using its resources. There are many different efficiency ratios, but some of the most important ones include the following:

- The labor efficiency ratio measures how much revenue a company generates per employee. A ratio of 1.0 or higher is considered healthy.

- The inventory turnover ratio measures how quickly a company sells its inventory. A ratio of 2.0 or higher is considered healthy.

- The asset turnover ratio measures how efficiently a company is using its assets. A ratio of 1.0 or higher is considered strong.

Different factors affect ratios

There are a few different ways to calculate efficiency ratios, but the most common method is to divide a company’s operating expenses by its total revenue. This gives you the percentage of revenue that is being spent on operating expenses. The higher the percentage, the less efficient the company is. There are many different factors that can affect a company’s efficiency ratios, such as the industry it operates in, the size of the company, and the economic conditions. However, companies with low-efficiency ratios are generally considered to be more efficient than companies with high-efficiency ratios.

What are the benefits of financial statement analysis?

Financial statement analysis impacts decision-making in a number of different ways. By carefully examining a company’s financial statements, you can gain valuable insights into its financial health and performance. This information can be used to make decisions about whether or not to invest in a company or to assess a company’s relative financial strength. Financial statement analysis is an essential tool for any investor or business decision-maker.

Financial statement analysis can provide insights that may not be immediately apparent when looking at a company’s financial statements. This type of analysis can be used to identify trends or problems that may not be immediately apparent when looking at a single financial statement. Additionally, comparative analysis can be used to compare a company’s financial information to that of its competitors. This can be helpful in assessing a company’s relative financial strength. Financial statement analysis is a powerful tool that can be used to impact decision-making in a number of different ways.

Overall, financial statement analysis is a powerful tool that can be used to provide insights into a company’s financial health. However, it is important to understand the limitations of this tool and to use it in conjunction with other information about the company, such as its history and business operations.

Problems with Financial Statement Analysis

Financial statement analysis is not without its problems, however. One problem that can arise is that financial statements can be misleading. For example, a company may choose to include only certain types of expenses in its Financial Statements. This can give a false impression that the company is more profitable than it actually is. Additionally, Financial Statements can be difficult to interpret, and even experienced analysts can sometimes come to different conclusions about the same set of Financial Statements. This can make reaching a consensus about a company’s financial difficulty. Finally, Financial Statements are historical documents, and as such, they can only provide information about a company’s past performance. They cannot be used to predict a company’s future performance. Despite these problems, Financial Statement analysis is a powerful tool that can be used to provide valuable insights into a company’s financial health.

Limitations

Notwithstanding problems, financial statement analysis can be a useful tool for assessing a company’s financial health. However, it is important to understand the limitations of this tool and to use it in conjunction with other information about the company, such as its history and business operations. Financial statement analysis has its pros and cons, but when used correctly, it can be a valuable tool for making investment decisions.

Summary of financial statement analysis

In summary, the techniques of financial statement analysis are a powerful tool to assess a company’s overall health. By understanding the different analysis types, investors and analysts can gain valuable insights into a company’s business operations and make informed decisions about whether to invest in or lend to a company. Financial statement analysis can be used to identify trends or problems that may not be immediately apparent when looking at a single financial statement. Additionally, comparative analysis can be used to compare a company’s financial information to that of its competitors.

A useful tool

The financial statements analysis is a useful tool, however, it can be difficult to interpret these results. Financial statements can be difficult to interpret because many numbers and ratios are involved. In order to understand what these numbers and ratios mean, you need to have a strong understanding of accounting principles. This can be difficult for people who are not accountants or financial analysts. Additionally, even experienced analysts can sometimes come to different conclusions about the same set of financial statements. This can make reaching a consensus about a company’s financial strength difficult.

Consequently, financial statement analysis can give you insights into a company’s financial health and whether to pivot. However, there are some limitations to this tool. Financial statements can be difficult to interpret, and even experienced analysts can sometimes come to different conclusions about the same set of financial statements. Additionally, Financial Statements are historical documents, and as such, they can only provide information about a company’s past performance. They cannot predict a company’s future performance. Despite these problems, Financial Statement analysis provides valuable insights into a company’s financial health.

FAQs

What is Financial Analysis?

Financial Analysis is the examination of financial information to make business decisions.

What is the goal of Financial Analysis?

Financial Analysis aims to reach business decisions by examining a company’s financial information.

What are some of the decisions that Financial Analysis can help with?

Financial Analysis can help with decisions such as whether to invest in a company, or whether to lend money to a company.

What are the limitations of Financial Analysis?

Financial Analysis has some limitations, such as that it can be difficult to interpret the results, and that Financial Statements are historical documents that can only provide information about past performance. Despite these limitations, Financial Analysis is still a powerful tool that can provide valuable insights.