Private Company Valuation: What You Need To Know

The current economic conditions, including the impact of COVID-19, hyperinflation, and supply-chain issues due to the Ukraine/Russia War, may make it more challenging to get the capital you need. However, taking stock of your capital needs is essential and figuring out how best to meet them.

Valuing private companies is a challenge. A company valuation supports your strategies and assertions when seeking new funding. However, the valuation process for a private company can be intimidating, but it’s essential to understand it to secure further funding. Unlike publicly traded companies, private company valuations pose a more challenging determination. This article provides everything you need to know about private company valuation.

Being prepared: The need to know private company valuation methods

One way to do this is by looking at private company valuation in preparation for a sale, raising debt or equity funding, or simply for your understanding. A private company valuation will help you determine how much your business is worth and what it would take to sell it.

Overall, it is crucial for business owners and managers to understand various private company valuation methods and be prepared for a more challenging credit environment. Regardless of where your company falls on the credit spectrum, take stock of your capital needs and determine how best to meet them. It is more important than ever to be proactive and understand your options with the current economic conditions. Obtaining a private company value is essential for measuring the direction of the business.

Why comprehending private company valuation methods is essential?

Unfortunately, most business owners and managers do not realize that understanding valuation methods provides a crucial insight into how to measure, manage, and maximize their business.

As mentioned, a business valuation can be done for many reasons, such as:

- To help determine a selling price for the company

- To help secure new funding

- For your understanding

Do you know the goal of business? Creating business value

You will be surprised that most business owners and managers do not know the goal of business. Unfortunately, some even believe that the purpose of business is to create profits, cash flows, employment, or even social good. These are parts that help develop. The company’s goal. The goal of the business is to create enterprise value (EV).

Common private company valuation techniques

Private companies tend to use the following to determine enterprise value:

- Comparable company analysis method

- The discounted cash flow technique

The comparable company analysis method looks at public companies with similar characteristics, while the discounted cash flow technique estimates future cash flows and discounts them back to the present day.

The comparable company analysis’s objective is to value an asset based on how similar an asset’s current price is relative to the market. Whereas the discounted cash flow valuation’s aim is to find the value of an asset based on its cash flows, growth, and risk characteristics.

Comparable company analysis

The first, the comparable company analysis (CCA) method, is a valuation technique that uses the financial performance of similar public companies to estimate the value of a private company. The CCA method uses several key metrics, such as revenue, earnings before interest and taxes (EBIT), and free cash flow (FCF), to compare the private company with its public peers.

Using the attributes of comparable companies is a means to assess value. The comparable company analysis method is a valuable tool for estimating the value of a private company. However, it is vital to understand the limitations of the technique. If the private company does not have public peer groups comparable in size and business model, then the CCA method will not be accurate. In addition, the CCA method is only as accurate as of the public companies’ financial information. If the financial information of the public companies is inaccurate, then the CCA valuation will be incorrect.

What is free cash flow (FCF)

Free cash flow is the cash that a company has available to pay its debts and distribute to its shareholders. The DFC method often uses free cash flow as an essential metric in estimating the value of a company. The free cash flow reflects a company’s cash to pay its debts and distribute to its shareholders after reinvesting.

Thus, there are two main ways to calculate the free cash flow: direct and indirect methods. The direct method starts with the net income of a company and adjusts it for items that do not affect cash. The indirect method starts with the operating cash flow and adjusts it for items that do not affect cash.

Three critical steps in relative valuation.

When using CCA, three steps are necessary 1) find comparable companies, 2) scale market prices to standard prices, and 3) make adjustments for different asset classes.

Step 1: Find comparable companies

There are a few steps that you can take to select comparable companies for your analysis. First, you should identify companies in the same industry as the company you are valuing. Second, you should select companies that are of a similar size. Third, you should select companies that have similar business models. Fourth, you should select companies that are located in similar geographic regions. Fifth, you should select companies that have similar financial characteristics. Overall, finding comparable companies is essential for the CCA method to work.

Step 2: Scale to produce standardized prices

There are a few steps that you can take to scale the market price to a common variable. First, you should identify the market price for each company. Second, you should identify the variable that you will use to scale the market prices. Third, you should calculate the standardized price for each company. Fourth, you should compare the standardized prices to identify the undervalued or overvalued companies. Consequently, standardizing prices enables you to normalize prices.

Step 3: Adjusts for differences across asset classes when comparing standardized values

Adjustments are typically done by applying a multiplier to the comparable company’s value. The most common adjustments made are for differences in size, growth rate, profitability, and risk. Larger companies are typically worth more than smaller companies requiring size adjustments.

In the case of faster-growing companies, we make adjustments. Profitability adjustments are made to account for the fact that more profitable companies are typically worth more than less profitable companies. We make risk adjustments to account for the fact that riskier companies are typically worth less than less risky companies. Overall, the process is like fitting a round peg into a square hole. Remember it must make sense.

The Discounted cash flow method

The discounted cash flow (DCF) method, an intrinsic valuation determinant, is a valuation technique used to estimate the value of a company. The DCF approach calculates the present value of all future cash flows expected to be generated by the company. This method takes into account the time value of money or the fact that a dollar today is worth more than a dollar tomorrow. The discounted cash flow method is often used by investors to estimate the intrinsic value of a company’s ownership.

What are the DCF key input factors?

The DCF method has several key inputs: discount rate, terminal value, and cash flow projections. The discount rate is the required rate of return that an investor expects to earn on an investment. The terminal value is the projected cash flow beyond the forecast horizon for the period. The cash flow projections are based on a number of factors, including historical financial data, current economic conditions, and company-specific data. Therefore, critical company-specific factors are essential.

Is the DCF method a complex company valuation technique?

The DCF method is a complex valuation technique that should be performed by a qualified professional. However, there are some key things that you can do to prepare for the process. First, it is important to gather all of the relevant financial information for your company. This includes historical financial data, current economic conditions, and company-specific data. Second, you need to select an appropriate discount rate. The discount rate should reflect the riskiness of the company’s cash flows. Finally, you need to make reasonable assumptions about the cash flow projections for the company.

Why are DCF inputs and assumptions critical?

The DCF method is a powerful tool that can be used to estimate the value of a company. However, it is important to understand the inputs and assumptions that go into the calculation. The discount rate, terminal value, and cash flow projections are all critical factors in the valuation methods.

Enterprise value

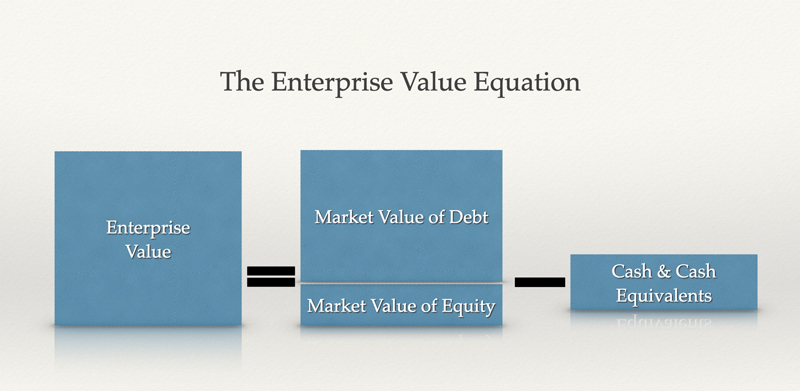

The first step in any business valuation is to define what the company’s enterprise value (EV) is. Enterprise value is the sum of a company’s equity value, preferred equity value, and debt value. Equity value is the market capitalization of a company’s common stock. Preferred equity value is the market capitalization of a company’s preferred stock. Debt value is the face value of a company’s debt. Overall, the EV is the market value of equity and the market value of debt less cash and cash equivalents as follows:

Enterprise Value = Market Capital + Market Value of Debt – Cash and Equivalents

Consequently, the private equity value is as follows:

Private equity value = Enterprise value – market value of debt

Why do people value private companies?

Valuation plays a crucial role for businesses as well as investors and lenders. A valuation can be useful for businesses and can help them track their performance in the market versus competitors. Investors can make monetary value decisions based on their valuation. The data may be used for such purposes by releasing information to companies and the like. The publicly-traded company valuation is based mainly on the company value regardless of the purpose. Unlike public companies, determining private company values is not comparatively straightforward compared with public firms. Data about private companies are largely available. Furthermore, valuations for public and private companies are different.

What is the book value is not the fair market value?

A company’s book value is not the same as the fair market value. According to its balance sheet, the book value is what the company is worth. This includes the amount of money that the company has in assets and how much it owes. However, this does not always reflect the true value of a company. The fair market value is what someone would be willing to pay for the company on the open market. This takes into account factors such as the company’s earnings power and growth potential.

A company’s book value is not always a good indicator of its fair market value. In some cases, the book value can be significantly higher or lower than the company’s true value. This is why it is important to understand the difference between the two concepts. The book value is a snapshot of the company’s worth at a particular point in time. The fair market value takes into account a variety of factors that can affect the company’s value over time.

The book value is not the best indication of private company valuation

When valuing a company, it is essential to use the appropriate method. The book value is the accounting value. However, the book value is not the best indicator of the company’s true worth. In most cases, the fair market value will be a more accurate representation of the company’s value. This is why it is important to understand the widely used methods such as CCA and DCF.

Private Company Valuation Methods: They’re NOT the Same, Silly

You still have similar valuation methodologies that you used for public companies, such as similar companies analysis, precedent transactions, and the discounted cash flow method. Generally speaking, the private market is unable to employ certain methodologies used for public companies, such as premium analysis based upon the share-price premium the buyer has paid for the public sale of shares. Private companies can’t use those methods as there are no share prices. The overall valuation difference is largely the same.

Problems with Private Company Valuations

Keep in mind that a private company valuation is not exact, but provides a generally accepted valuation outcome based on the method used. The fact is, the calculation is based solely on dozens or more assumptions and estimates. In addition, rare incidents can affect comparable firms and influence their valuations. Sometimes, such situations are hard to take into account a lot and usually require greater reliability. In comparison, widely traded publicly held company valuations generally tend to be more concrete because their value depends on actual numbers.

Determining capital structure

Although finding capital structures is sometimes difficult to calculate, industry averages may be useful in determining this. Although equity and debt costs for private companies will likely exceed those of their publicly-traded counterparts, small adjustments could be necessary to account for these higher costs of capital. The costs of equity can increase to compensate for the lack of liquidity when holding the equity positions at the firms. This makes the capital structure essential in determining the weighted average cost of capital. The weighted average cost of capital establishes the discount factor.

The DCF method Starts with the Financial statements

When beginning the process with privately held firms, we look at the current financial statements. To accurately value a company using the DCF method, you’ll need to clearly understand the company’s financial statements and projections.

Capital Structure

First, look at the company’s capital structure. A company’s capital structure determines the weighted average cost of capital. Second, review the company’s debt structure including short-term debt and long-term debt. Some companies issue various forms of debt at different interest rates and amortization schedules. Lastly, assess whether the company has different forms of equity and dividend policies.

Projections

The most common type of projection used in the DCF method is the straight-line method. This approach projects that a company will grow at a constant rate into the future. While this is not always accurate, it is a simple way to project future growth.

Other types of projections used in the DCF method include the terminal value and growth factor. The terminal value method projects a company’s value at the end of the projection period. The growth factor method projects a company’s growth based on its past growth rates.

Calculating the discount rate using the weighted average cost of capital (WACC)

WACCs are a necessary component of DCF valuations. Simplistically, the companies’ capital comes from primarily two sources: (1) debt and (2) cash. The WACC combines the cost of debt and the cost of equity. Note that a discount should match intended recipients for the expected cash flows in the DCF. Thus, the WACC is the correct discount rate.

Cost of debt:

The cost of debt is the interest rate that a company pays on its debts. We start by reviewing the risk-free rate and then the credit risk rate of the company.

- Risk-free rate: The risk-free rate is the interest rate that investors expect to earn on an investment with no risk. The risk-free rate is used to calculate the cost of equity. The cost of debt is the interest rate that a company pays on its debts.

- Credit risk rate: We must determine the company’s credit risk by reviewing historical and current rates.

Knowing the risk-free rate and the credit risk rate allows you to better peg the proper cost of debt. Consequently, some companies have several trunches of debt making the calculation more complex.

Cost of equity:

The cost of equity is the return that shareholders expect to earn on their investment.

- The capital asset pricing model: We use the capital asset pricing model (CAPM) to determine the cost of equity. The CAPM calculates the cost of equity by adding a risk premium to the risk-free rate. The risk premium is the return that shareholders expect to earn for bearing the additional risk of investing in a company.

Weighted Average Cost of Capital

Weighted cost of capital: The WCC is the combined cost of debt and the cost of capital discount rate. The WACC is calculated by weighting the cost of debt and the cost of equity. The cost of debt is weighted by the percentage of debt in the capital structure. And the cost of equity is weighted by the percentage of equity in the capital structure. Furthermore, The weighted average cost of capital represents the businesses’ average cost of capital including common stock, preferred stock, bonds, and other tranches of debt.

Terminal value

The terminal value is the projected value of a company at the end of the projection period. The straight-line method projects that a company will grow at a constant rate into the future. The growth factor method projects a company’s growth based on its past growth rates. We discount the terminal value to the present. Consequently, the terminal value is the value of the business beyond forecasted cash flows.

In summary

The two main valuation techniques are the comparable company analysis and discounted cash flow technique. The CCA compares private company assets to similar public company assets. And the DCF method discounts future cash flows and the terminal value to the present day.

The objective of comparable company analysis is to value an asset based on how similar an asset’s current price is relative to the market. Whereas the aim of a discounted cash flow (DCF) valuation is to find the value of an asset based on its cash flows, growth, and risk characteristics. The DCF method uses all this information to estimate a company’s intrinsic value–what it would be worth if you bought it and held it indefinitely.

The two main inputs into a DCF valuation are the discount rate and the terminal value. Taking the weighted average cost of capital as the discount rate. We discount future cash flows to the present value. The terminal value is the projected value of a company at the end of the projection period. We then discount the terminal value to the present value.

Consequently, the two main methods for estimating the terminal value are the straight-line method and the growth factor method. The straight-line method projects that a company will grow at a constant rate into the future. The growth factor method projects a company’s growth based on its past growth rates.