How Financial Statements are Linked, Telling a Story

Financial literacy is critical for business owners. It gives them the ability to understand and use financial statements to make informed decisions about their business. Furthermore, financial literacy also allows business owners to make choices that free up money to reinvest in their business or themselves, leading to greater life satisfaction. While financial literacy may seem like a complex topic, it is actually quite simple: it is the ability to understand and use financial information.

Why Financially Literacy is Important

By gaining a basic understanding of financial statements and learning how to use financial information, business owners can establish a feeling of control over their finances. This, in turn, allows them to make choices that build greater life satisfaction.

Knowing the State of the Busines

Business owners and investors need to review their company’s financial statements regularly to make informed decisions about the future of the business. However, you need to know about the present “state of the business.” You need to know the story. Using the income statement, balance sheet, cash flow statement, and Shareholders’ Equity Statement provides “a story” of the enterprise. statements and linked. The Income Statement will show how much money the company has earned over a period of time, while the Cash Flow Statement will show how much cash the company has generated and used. The Balance Sheet will show the company’s assets, liabilities, and equity. And the Shareholders’ equity statement shows how the worth of the business has changed.

What You Want to See

By reviewing these statements, business owners can identify areas where they need to make changes to improve their business’s financial health. Investors can also use financial statements to evaluate a company before investing money. Investors want to see a company with a healthy net profit, high sales, and good margins. Both also want to see a company generate cash flow and low customer churn rates. Finally, investors look at a company’s debt levels and the accounts receivable turnover to understand how efficiently the company is operating. Notwithstanding, by understanding what investors are looking for, business owners can improve their chances of attracting investment capital.

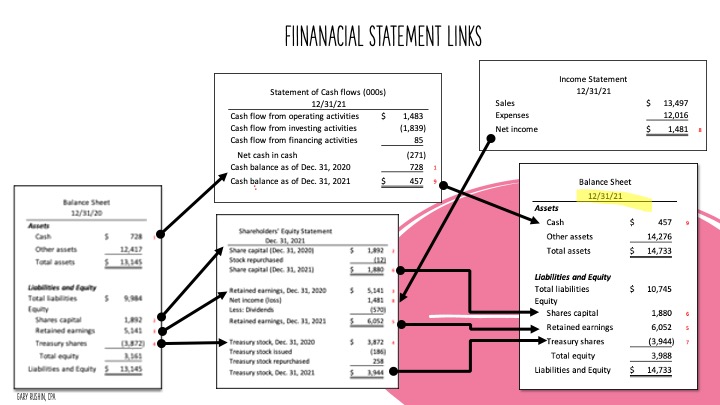

Did You Know Financial Statements are Linked?

The financial statements are connected because one statement impacts the other. The income statement measures a company’s profit or loss over a specific period of time. The balance sheet reflects the company’s assets, liabilities, and shareholder equity as of a particular date. As a result, the statement shows how cash flow from operating, investing, and financing activities has changed over time.

Knowing how the statements are related is important because it allows investors and analysts to understand a company’s financial health and performance. For example, if the income statement shows a loss, but the Balance Sheet reflects an increase in assets, this could be due to the company taking on debt. Conversely, if the cash flow statement shows an increase in cash flow, but the income statement shows a loss, this could be due to the company delaying payments to creditors.

How are financial statements linked?

By understanding how the statements are connected, business owners, investors, and analysts can better assess a company’s financial position and decide whether to or how to invest in the company. And this includes how linked financial statements are.

Balance Sheet

The balance sheet links to the income statement. Calculating retained earnings on the balance sheet is from net income reported from the income statement. The balance sheet is used to calculate retained earnings on the balance sheet and shareholders’ equity statement. As a result, the balance sheet is also linked to the cash flow statement because the ending cash generated from the cash flow statement is shown as the starting cash on the balance sheet.

Income Statement

Most people are familiar with the income statement, which is one of the three major financial statements used to gauge the financial health of a business. What many people don’t realize, however, is that the income statement is actually linked to the cash flow statement. The cash flow statement shows the inflows and outflows of cash for a business, and net income from the income statement is used to calculate cash flow from operating activities on the cash flow statement. Thus, it’s important to have a basic understanding of both financial statements in order to get a complete picture of a business’s financial health. Additionally, being financially literate can help you make sound financial decisions in your personal life as well.

Cash Flow Statement

The Cash Flow Statement is one financial statement that enables you to understand a company’s financial health. The statement shows components that generate cash during a specific period of time. The statement consists of cash from operations, cash from investing, and cash from financing. Each section includes several line items that show the different sources and uses of cash. The Cash Flow Statement links to the Balance Sheet and the Income Statement. Ending cash on the Balance Sheet calculates cash flow from operations on the Cash Flow Statement. And net income from the Income Statement calculates cash flow from operations on the Cash Flow Statement. By understanding the links between these financial statements, we can gain a better understanding of a company

Statement of Shareholders’ Equity

The shareholders’ equity section of financial statements lists the capital that belongs to a company’s shareholders. Shareholders’ equity includes common stock, paid-in surplus, and retained earnings. The common stock section lists the par value of the stock, the number of shares authorized, the number of shares outstanding, and the market value per share. The paid-in surplus section shows the amount of money invested in the company by its shareholders. The retained earnings section lists the net income or loss that the company earned since it the company’s founding, minus any dividends paid out to shareholders. Together, these three sections provide a complete picture of a company’s financial health.

Financial Statements tell a Story

Income Statement

The Income Statement is one of the financial statements that companies use to provide information about their financial performance. This statement shows us how much money a company has earned over a specific period, and it helps us see whether or not the company is making a profit. The Income Statement also tells us how much revenue the company has generated from its sales, and it shows us the company’s expenses over that same period. Comparing the current period to the previous period tells us the story of the company’s profitability trend. financial literacy is important for investors, creditors, and other stakeholders who need to understand a company’s financial performance. Thus, the Income Statement is just one of the financial statements that companies use to communicate their financial story.

Cash Flow Statement

The Cash Flow Statement is one of the most important financial statements for any company. It tells us where a company’s money is coming from and where it is going. This information can be extremely helpful in spotting any financial problems a company may have. The cash flow statement is a summary of all the cash inflows and outflows for a specific period of time. It is important to note that the cash flow statement is not the same as the profit and loss statement. The profit and loss statement only takes into account the revenue and expenses for a specific period of time, while the cash flow statement includes all cash inflows and outflows, regardless of when they occurred. Therefore, the cash flow statement is an essential tool in financial literacy.

Balance Sheet

The Balance Sheet is one of the financial statements that companies use to report their financial position. The Balance Sheet consists of two sections: Assets and Liabilities. The purpose of the balance sheet is to give shareholders and other interested parties a snapshot of the company’s financial position at a specific point in time. The balance sheet compares the company’s financial position from one period to another. This comparison can be helpful in assessing the financial health of the company. For example, if the assets of the company have increased while the liabilities have remained the same, this may indicate that the company is in a strong financial position. Conversely, if the liabilities of the company have increased while the assets have remained the same, this may indicate that the company

The Statement of Shareholders’ Equity

This statement tells us how the ownership of a company has changed over a specific period of time. The statement of retained earnings is one of a company’s financial statements. The statement shows how the ownership of a company has changed over a period of time. The report gives us a brief history of the company’s profitability. This statement can help us to see if a company is healthy financially or not. The statement of retained earnings is important because it provides information about a company’s financial history. All told, the information allows for making informed decisions.

The Note to Financial Statements

The footnotes provide additional information about the financial statements. It attempts to explain why specific numbers have changed from one statement to another. The footnotes give more details about particular items on the statements. And it provides additional schedules and explanations that enhance the story of the business. With the financial statements, the footnotes help understand the overall financial health of a company. They can be helpful in comparisons between companies, or between financial statements of the same company over time. Financial literacy is important in making investment decisions. Reading and understanding financial statements is a critical part of that literacy. Notwithstanding, the footnotes provide valuable information that can help investors make more informed decisions.

Conclusion

The financial statements tell the company’s story. You should review them regularly. With this information, you make informed decisions about the future of the business. By understanding how each statement impacts another, business owners can make more informed decisions about their company’s future. Have you ever looked at your company’s financial statements? If not, we suggest you start today. It may be difficult to understand everything at first. But you will be able to tell a story with your numbers with time and patience. All told, the story could very well determine the fate of your business.

Courses Designed for You

Read the financial statements through:

Understanding the balance sheet, income statement, and cash flow statement, even if you have no experience with financial statements.

Interpret financial statements through:

Analyzing financial statements using profitability ratios i.e., Gross Margin (Cost of Goods Sold / Revenue), Operating Margin (EBITDA/ Revenue), Net Profit Margin (Net Income / Revenue), Return on Assets (Net Income / Assets), and Return on Equity (Net Income / Equity).