Entrepreneur: Understanding Accounting, the Business Scorecard

"Accounting is historical information that provides a story of how well your business is doing and what you own!"

Gary Rushin, CPA

Entrepreneur: Understand Accounting, the Business Scorecard

If there is a secret about why you need to understand accounting (the business scorecard), the answer is that accounting – through the financial statements – tells a story! Knowing the importance of business accounting will enable you to make informed decisions and money!

Why do you need to understand accounting?

I understand your pain when you tell friends that you cannot read your company’s financials or the business scorecard. It is because you don’t understand accounting. How do you determine whether your business is making money or will your decision help your company? It does not matter whether you play a board game, golf, or tennis; knowing how to read any scorecard will determine where you stand.

In this post, I attempt to discuss significant reasons why accounting is essential for entrepreneurs.

Determining your business’s health

Well, in business, it is critical to understand accounting to understand where your business stands!

Although it has been many years, as an undergraduate, many said, “Ugh, taking accounting?” when the course is required. Many would say that it was too hard or accounting is so dull. Let me say that neither is so further from the truth.

Accounting is Storytelling in the form of numbers. And accounting is exciting if you have a good storyteller. And the storyteller cumulates the cumulative financial statements, i.e., the income statements, the balance sheet, the cash flow statement, the shareholder’s equity statement, and the accompanying footnotes.

When you think about it, accounting is just telling a company’s story. It takes all the financial information a company has gathered and puts it into a format that is easy to understand. The financial statements include how much money a company has made, how much money it has spent, and how much it has left.

How you handle money matters in entrepreneurship will dictate whether or not the business idea you’re building on will be successful. But how do you measure success? Understanding accounting.

When many enter entrepreneurship, they’re carried away by marketing and sales strategy to forget about accounting and finances. However, accounting is equally important as any other primary aspect of entrepreneurship. Accounting allows you to read what is happening with your business

What is accounting?

Generally speaking, accounting is the detailed and systematic recording of financial transactions and organizing /understanding of the financial information of a business. However, this is a broad term that encompasses a plethora of components, including but not limited to:

But let me repeat myself, accounting is Storytelling. Accounting deals with historical events in a generally accepted format that allows one to read what happened. Understanding accounting is no different from comprehending a well-written novel. It is about understanding the business code.

Accounting applies on all business fronts, from startups to industry leaders. A core to all business success is accounting. It would help if you had a grasp of accounting, from applying for a loan to knowing the amount to save or invest back into the business for growth.

Double-entry system

The double-entry system is a fundamental principle of accounting that ensures recording financial transactions in a way that accurately reflects the economic reality of the business. This system requires recording every transaction in at least two places, with the total debits always equaling total credits. The double-entry system helps ensure the accuracy of financial statements and prevents fraud.

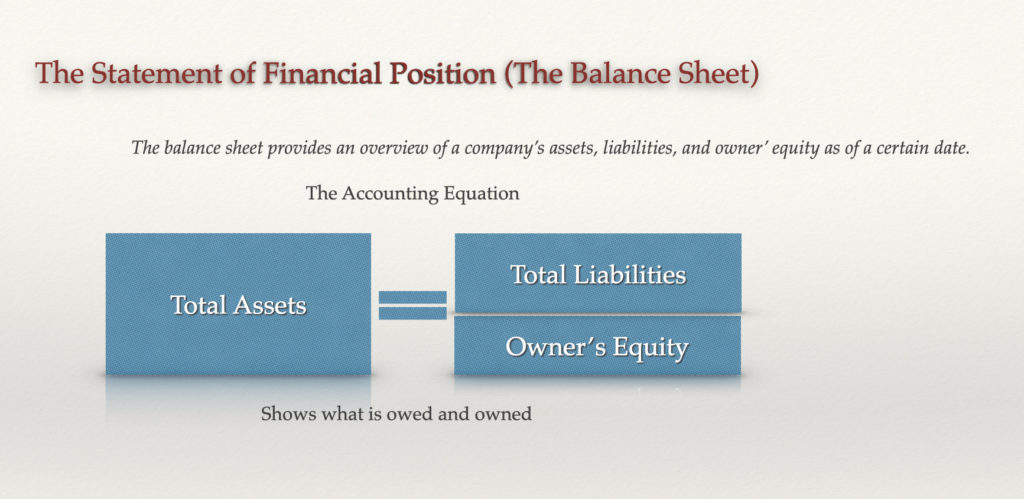

Accounting equation

The accounting equation is a fundamental principle of accounting that states that all assets are equal to the sum of liabilities and equity. This equation is critical because it helps ensure that the financial statements are balanced.

Generally accepted accounting principles (GAAP)

Now let me explain the rules known as GAAP. Generally accepted accounting principles (GAAP) are rules and guidelines companies must follow when preparing their financial statements. GAAP is important because it ensures that financial statements are consistent and comparable across companies.

Journal entries

Journal entries are the building blocks of accounting. A journal entry is a financial transaction record that includes the date, amount, and accounts affected by the transaction. Journal entries cumulate into the financial statements.

Dissecting the financial statements

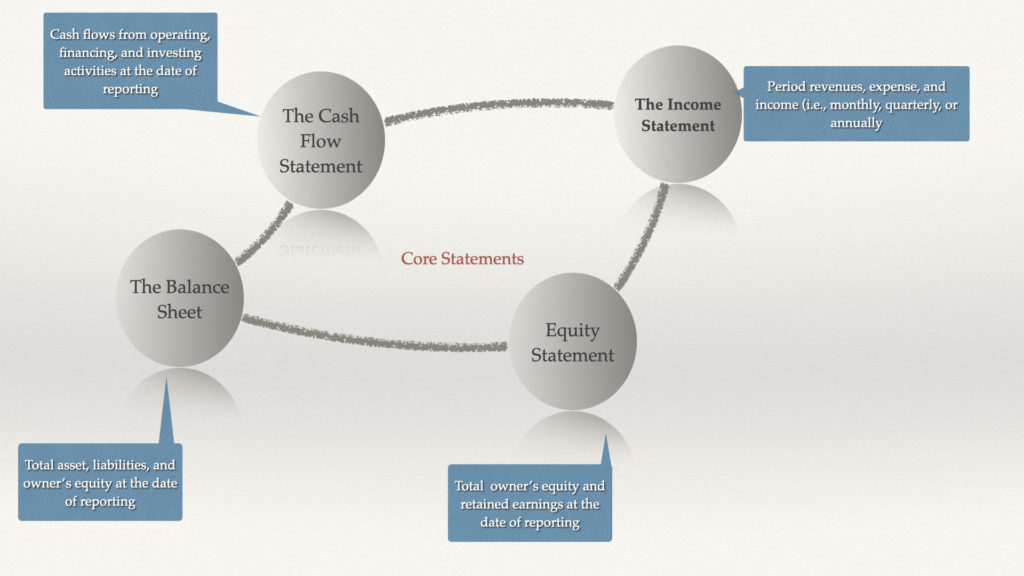

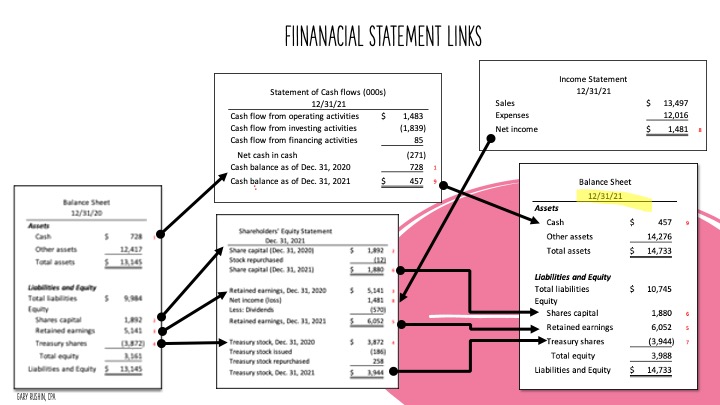

Financial statements are a vital part of accounting that summarizes a company’s financial position, performance, and cash flow. Investors, creditors, and others use financial statements to decide whether to invest in a company. The part of the financial statements include:

The balance sheet

The balance sheet is one of the critical statements used in accounting. Consequently, the balance sheet shows a company’s assets, liabilities, and equity at a specific time. Therefore, the balance sheet is vital because it provides a snapshot of a company’s financial position.

Income statement

The income statement is another critical statement used in accounting. The income statement is also known as the profit and loss statement or P&L. It shows a company’s revenue, expenses, and profit over a specific period. Hence, the income statement is important because it summarizes a company’s financial performance.

Cash flow statement

You should know that the cash flow statement is a crucial financial statement that summarizes a company’s cash inflows and outflows over a specific period. Determining the cash-offs is essential because it outlines a company’s cash flow activities, including operating, financing, and investing activities.

Shareholder’s equity statement

Often overlooked, the shareholder’s equity statement is a crucial statement used in accounting that shows the changes in a company’s equity over a specific time. The shareholder’s equity statement is essential because it summarizes shareholders’ financial position.

Overall, you will notice that financials are linked.

Footnotes

Financial statement footnotes are a vital part of accounting that provides additional information about a company’s financial position (balance sheet), performance (income statement), and cash flow.

Some common detailed footnotes and schedules include:

Financial statement footnotes are important because they provide more information about a company’s financials. As a result, investors and creditors can use this information to make better-informed decisions.

Accounting, Storytelling about the business

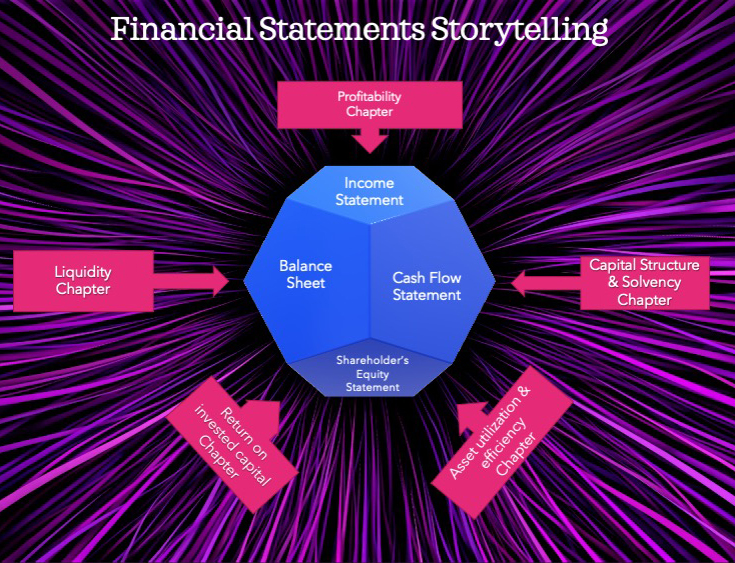

Unfortunately, most do not realize that accounting through financial statements provides a story. Detailed information or stories from the financial statements include profitability, liquidity, the capital structure including solvency, asset utilization including efficiency, and return on invested capital about your company. Utilizing ratio analysis provides additional information.

Profitability

A company’s profitability is essential to assess whether it is a good investment. Profitability is a company’s ability to generate revenue and profit. A company that is not profitable will not be able to generate enough revenue to cover its costs and will eventually go out of business. Profitability is, therefore, a key metric for investors to assess when considering whether to invest in a company.

To calculate a company’s profitability, one can use various financial ratios such as the gross margin ratio, net profit margin ratio, or return on assets ratio. These ratios measure a company’s ability to generate profits concerning its revenue or assets. A company with a high profitability ratio is more likely to be a good investment than a company with a low profitability ratio.

Liquidity

A company’s liquidity is its ability to pay off its current liabilities with its short-term assets. Current assets are cash and other assets that can be turned into cash quickly, such as investments, inventory, and accounts receivable.

Astute business owners compare a company’s current assets to its current liabilities to assess its liquidity. If the company has more current assets than current liabilities, it is said to be “liquid.” If it has more current liabilities than current assets, it is “illiquid.” A company’s liquidity gives insight into its short-term financial health.

A highly liquid company may not have enough cash on hand to cover its long-term expenses, while an illiquid company may not be able to meet its short-term obligations. Therefore, you must consider a company’s liquidity when assessing its financial health.

The capital structure and solvency

A company’s capital structure refers to its mix of debt and equity to finance its operations. Leverage ratios are one way to measure a company’s capital structure. These ratios compare a company’s obligation to its equity and give investors an idea of how risky the company is.

A company with a high leverage ratio is more likely to default on its debt payments if its earnings decline. However, a company with a low leverage ratio has a cushion of equity to fall back on in times of trouble.

Solvency refers to a company’s ability to meet its financial obligations. A solvent company has enough cash to pay its debts when they come due. On the other hand, an insolvent company does not have enough liquidity to pay its debts and may have to declare bankruptcy. In general, investors prefer companies with low leverage ratios and high solvency.

Return on invested capital

ROIC stands for return on invested capital. It is a financial ratio that measures how much profit a company generates with the shareholders’ money. ROIC is calculated by dividing a company’s after-tax operating income by its total capital. The total capital includes both debt and equity. ROIC is a good measure of how efficiently a company uses capital to generate profits.

The financial statements can derive the ROA and ROCE ratios. ROA, or return on assets, is another financial ratio that measures profitability. ROA You calculate ROA by dividing a company’s after-tax operating income by its total assets. ROCE, or return on capital employed, is another financial ratio that measures profitability. You calculate ROCE by dividing a company’s after-tax operating income by its capital employed. Capital employed includes both debt and equity.

ROIC, ROA, and ROCE are all measures of profitability. Hence, these profitability ratios are essential financial indices when making investment decisions.

Necessary accounting acumen for entrepreneurs

Below are the basic but crucial accounting skills you need to know as an entrepreneur.

Profitability evaluation

As mentioned above, you’re in entrepreneurship mainly to make money. Evaluating the money your business makes after sales and expenses deducted (profitability) is paramount.

Profitability evaluation should form the core of your accounting strategies, as this is how you’ll know how you’re performing compared to your competitors. This accounting skill will help you adopt a profitability path that’ll see you achieving your business goals for a given period or pivot the company when necessary.

Managing cash flow

Cash is a critical asset for businesses, especially startups that don’t have access to other funding sources. Unless you manage your cash right from when you make your first sale, it’s hard to make notable progress in your business.

Good cash management ensures you have money to reach new customers, build inventory and pay your suppliers. Knowing what cash throw-off (in and out) of your business gives you an idea of the money you need every day, preventing cases of excessive use or shortages.

Additionally, financial statements enable you to perform business valuations. Critical to this effort is to measure indices and especially cash flows.

Communication skills

Yes, good communication is not something you’ll only need when striking deals with other entrepreneurs. You also need this skill when dealing with finances. As an entrepreneur or business owner, you must learn how to confidently communicate correct financial details with every stakeholder in your business.

Good communication in accounting aims to ensure that all parties in the business mix are aligned and have no misunderstandings.

If you’re working with multiple vendors, invoices, tax accountants, etc., you need to be clear about the protocols to be followed for these financial aspects. And in the development of a business plan, showing your financial acumen is crucial. Thus, proper accounting and financial communication skills help you achieve this and protect your business from conflicts.

Why understanding accounting is critical to running your business

Accounting measure the progress of your business.

There’s no way you’ll know whether your business is operating at a loss or a profit unless you have a good record of your expenses and revenue. Accounting helps you keep tabs on the funds moving in and out of your businesses to know if you’re making any progress.

It doesn’t matter if you’re operating a small or an established one, as knowing the progress you’re making is essential at all business levels. With the correct accounting information, you’ll have a better plan of the money to put back into your business. You’ll also design better strategies to reduce the loss or increase your company’s profits.

If you feel like recording and keeping your financial details will add to a load of tasks under your responsibility, you can always hire a professional to help you out.

Accounting makes it easier to plan for the future.

To be successful in business, you need to have some capacity to predict the future, as this will separate you from the rest and keep you at the top of the game. With a good plan for the future, you’ll always know where to put your money to get enhanced returns.

With good accounting strategies, you’ll plan your revenue and costs and have a clear picture of how financial aspects will affect your businesses in the future. Even better, you’ll know what amount you’ll save and invest in the future.

When you’re starting, you may not see the need to plan your finances. However, as soon as the real action begins, you’ll learn that planning what you’ll spend the following day in your business is essential.

Accounting keeps a business organized.

There is so much regarding finances that must be organized and stored correctly in your business. There’s loads of information to put together, from daily cash flow to monthly financial and tax reports. Accessing or retrieving information needed at a particular time may be challenging if your records are all over.

A business with well-organized financial records stuns external groups and entities and captures their attention into striking investment or partnership deals. This way, it’ll be easier to work with lenders and investors.

Accounting makes it easier to handle large sums of money

If you’re entrepreneurship on inheriting an already established business, the money flow may be too much for you to monitor. However, with an accounting system/accountant, you can have a simplified report of how the numbers change and their implications. The same case applies when you own multiple businesses.

When the money you make from your business increase, it also becomes more challenging to know what to pay as taxes. With sound financial records, you’ll always know what amount you need for taxes and when to commit.

Hire an accountant and make your life easier

You can effortlessly draft a working budget.

A budget is a crucial business tool as it guides most of the decisions you make for your business. You’ll always refer to the budget to understand the current standing of your business and its future. With correct financial records and good cash management, an adequate company budget becomes straightforward to create.

A budget is not a one-time creation- it needs to be updated depending on how the business performs. Again, financial understanding will help you make those crucial adjustments to your budget, leading your business towards growth.

A working budget maintains smooth business operations and provides a foundation for stability and growth.

You’ll avoid legal problems.

Every jurisdiction has business laws that help regulate business activities and affairs. There are many financial-related business laws, including those that guide tax management, that you need to follow to continue operating. With sound financial records, it becomes pretty easy to follow these laws.

As an entrepreneur, you need to record the taxes you need to pay, the amount of debt to pay, if there’re any, and expenses to deduct when preparing financial reports. Lack of this information or incorrect recording could see your business being audited and suspended.

Some financial business laws integrate with safety laws making it even more important to have correct and up-to-date information about your financial undertakings. Have reasonable control of your finances and financial details, and you’ll avoid unnecessary law-related issues.

It becomes easier to achieve your business goals.

Proper accounting is the key to the success and achievement of set goals in business. Adopting good accounting strategies will ensure that you have thoroughly analyzed data about your finances. With this, you’ll be better positioned to implement effective business practices that will lead you to achieve your goals.

With good accounting, you’ll make sound and guided financial decisions for your business and boost your profitability. If you’ve been finding it hard to achieve the goals you’ve set for your business, pay more focused attention to your finances, and you’ll see significant change.

Aids in filing financial statements

Generally, businesses are required to file their financial statements with the registrar of companies after a certain period. If your business is a listed entity, you’ll be required to file with the stock exchange. The same is needed from businesses for tax filing motives.

Anything that directly involves filing financial statements depends on accounting-it’s through accounting. You’ll have all the information needed to make the filings.

Make sound and real-time decisions.

Every decision you make in your business should be calculated and reflect a benefit rather than a setback in your company. With an accountant as your financial advisor, you’ll not make mistakes, such as hiring more employees or untimely updating your inventory.

Accounting helps you budget your money correctly and, in turn, face any challenge that comes your way. Additionally, accounting avails you updated data at all times, meaning that you make decisions anytime they are needed to be made.

With sound and real-time decisions, it’ll be easier to fuel your business towards growth.

You’ll get all your deductions.

So, what have we learned? Business owners need to understand financials and numbers in order to read the story that their financial statements are telling. The statements provide critical information about the business and how the owners can make decisions based on this data. I hope you’ve found this post helpful! If you have any questions, please comment below or reach out to me on social media. And be sure to follow me for more great content like this!

Conclusion

So, what have we learned? Business owners need to understand financials and numbers in order to read the story that their financial statements are telling. The statements provide critical information about the business and how the owners can make decisions based on this data. I hope you’ve found this post helpful! If you have any questions, please comment below or reach out to me on social media. And be sure to follow me for more great content like this!